Direct Tax In Malaysia

By josh white.

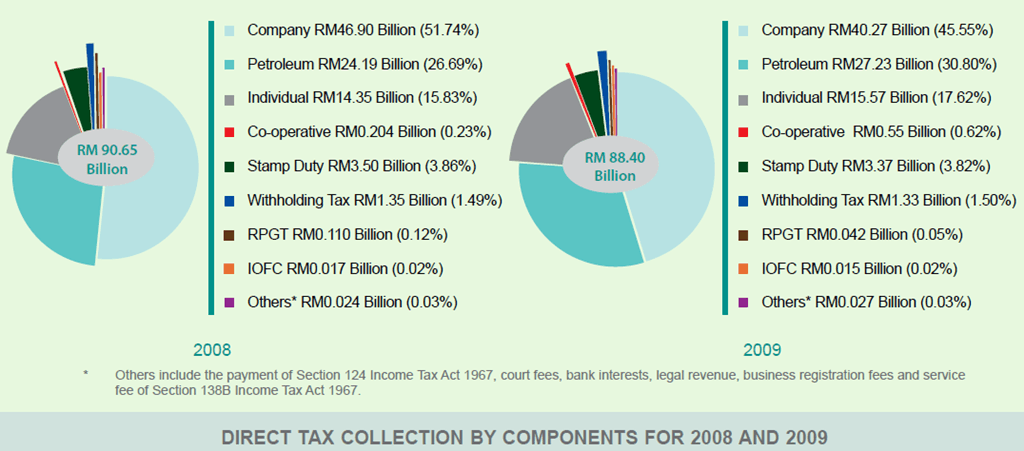

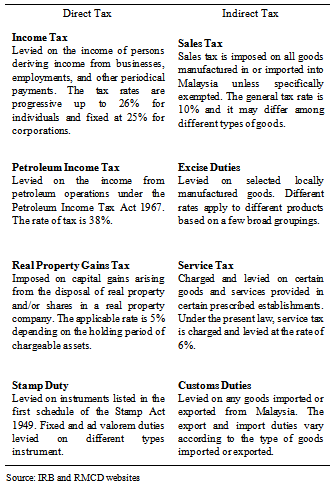

Direct tax in malaysia. If you are working in malaysia for more than 182 days a year the government considers you to be a tax resident and you will pay progressive tax rates and be eligible for tax deductions. Malaysia s progressive personal income tax system involves the tax rate increasing as an individual s income increases starting at 0 for up to rm5 000 earned to a maximum of 28 for annual income of over. 10 for sales tax and 6 for service tax. The inland revenue board of malaysia achieved a new record in direct tax collection last year with rm137 035 billion collected which is 11 13 or rm13 723 billion more than the rm123 312 billion collected in 2017 the ministry of finance mof said today.

Kuala lumpur jan 20. This week in tax. Taxpayer uncertainty at the brazil tax forum tax professionals find more uncertainty in international tax this week as the uk steps back on its brexit promises and experts at itr s brazil tax forum think tax reform in brazil risks more litigation. Type of indirect tax.

Sales tax and service tax were implemented in malaysia on 1 september 2018 replacing goods and services tax gst. The last record was set in 2014 when the direct tax collection came in at rm133 700 billion according to a. In addition taxes like estate duties annual wealth taxes accumulated earnings tax or federal taxes are not levied in malaysia. The income tax with the highest rate only recently being at 28 has been cut down now to 26 for residents and 27 for non residents.

This content is from. What supplies are liable to the standard rate. Since the repeal of the goods and services tax gst and the implementation of sales and service tax sst indirect tax risk has never been higher. Service tax is levied on prescribed taxable services while many goods are exempt from sales tax.

Price control and anti profiteering pcap conduct training for businesses on the pcap regulations and the impact it may have in determining pricing policy.