Entitled To Claim Incentive Under Section 127 Lhdn

Guna google search untuk kata kunci ehasil ezhasil atau lhdn.

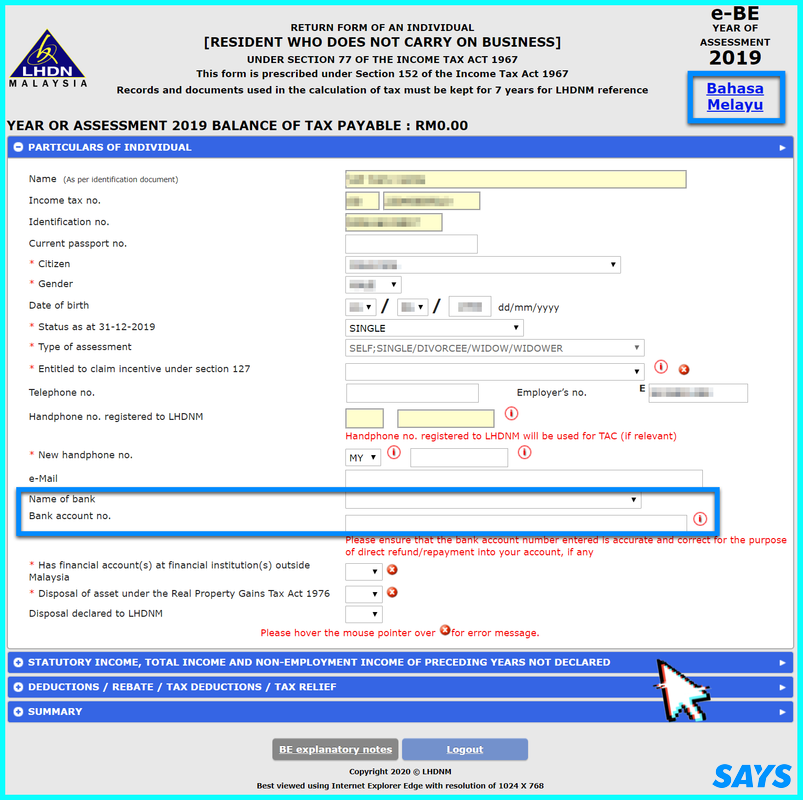

Entitled to claim incentive under section 127 lhdn. Bergantung kepada pengurus website lhdn url diatas mungkin akan berubah. Selamat mengisi dan claim semula duit cukai anda. Incentive under section 127 refers to the income tax act 1976. A7一栏 可以在127条文下申领奖励 entitled to claim incentive under section 127 这里的所谓 奖励 是指在1967年所得税法令下第127 3 b 或127 3a 条款下 获政府颁颁宪或有部长批准信 可以申领的奖励如豁免 如果你没有部长的批准信 那么就填写 tidak berkenaan.

There will also be a layak menuntut insentif dibawah seksyen 127 which refers to claiming incentives under section 127 of the income tax act ita 1976. It is only applicable to those who have incentives claimable as per government gazette or with a minister s approval letter. Anda boleh akses e filing lhdn dengan.

A7 entitled to claim incentive under section 127 2 approved donations gifts contributions 7 gift of money to an approved fund gift of money for any sports activity approved f8 lifestyle 13 f9 purchase of breastfeeding equipment for own 14 use for a child aged 2 years and. So unless a minister has statutorily exempted you from certain taxes it s probably not relevant to you. Sila rujuk bahagian cara tutup pop up blocker untuk panduan. This is incentives such as exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1976 which is claimable as per government gazette or with a minister s approval letter.

If you re curious about the entitled to claim incentive under section 127 the dropdown list allows you to claim under paragraph 3 a or 3 b which is listed below. Business income income arising from services rendered by an ohq company to its offices or related companies. I enter x in the box for the type s of incentive entitled to be claimed for. Type of incentives a incentive for ohq an approved ohq company is eligible for income tax exemption for a period of 10 years under section 127 income tax act 1967 for income derived from the following sources.