Entitled To Claim Incentive Under Section 127 Malaysia

This is incentives such as exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1976 which is claimable as per government gazette or with a minister s approval letter.

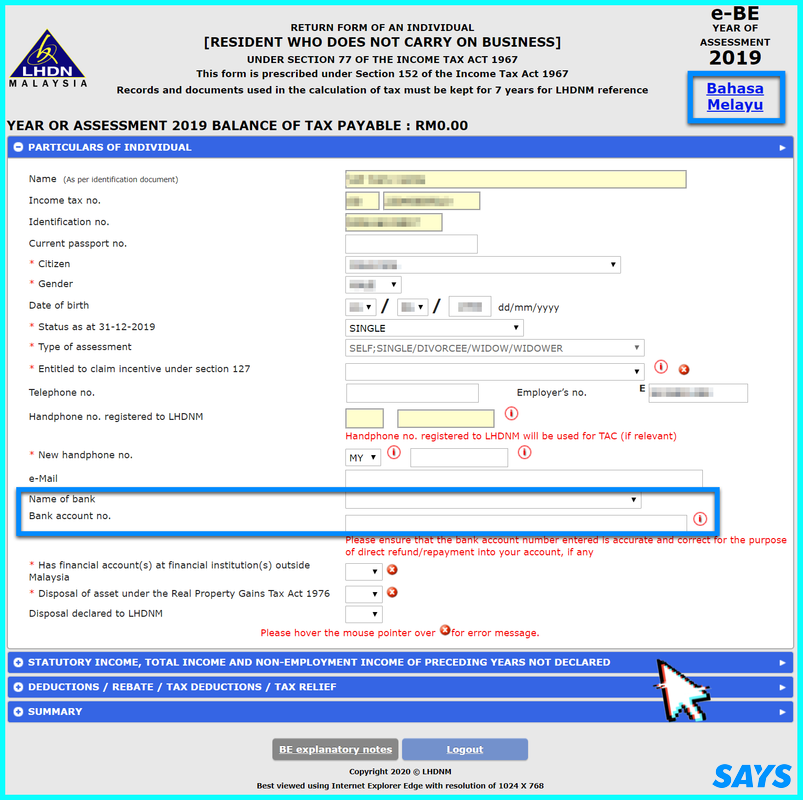

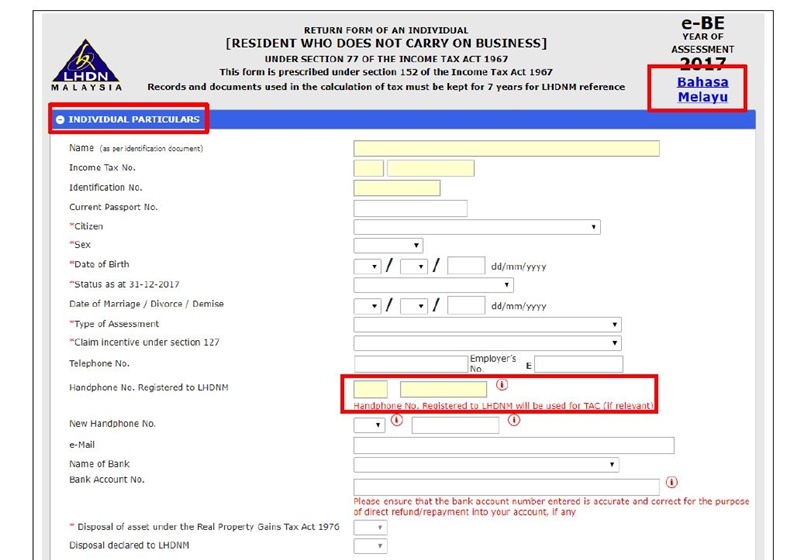

Entitled to claim incentive under section 127 malaysia. Type of incentives a incentive for ohq an approved ohq company is eligible for income tax exemption for a period of 10 years under section 127 income tax act 1967 for income derived from the following sources. 3 a7 entitled to claim incentive under section 127 refers to incentives for example exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1967 entitled to be claimed as per the government gazette or minister s approval letter. A tac which is needed to sign and submit your e form will be sent to your handphone number registered to lhdnm so ensure it is correct. Section 127 is to be covered.

So unless a minister has statutorily exempted you from certain taxes it s probably not relevant to you. A7 refers to incentives for example exemptions under the provision entitled to claim incentive under section 127 of paragraph 127 3 b or subsection 127 3a of ita 1967 entitled. Malaysian citizen if not resident in malaysia.

Section 127 1 income exempted under schedule 6 of the ita section 127 3 b exemptions made under gazette orders section 127 3a exemptions given directly by the minister of finance usually via a letter to the taxpayer. 1 paragraph 127 3 b of ita 1967. In pn 2 2018 the irb clarifies that the scope of exemption granted. It is only applicable to those who have incentives claimable as per government gazette or with a minister s approval letter.

There will also be a layak menuntut insentif dibawah seksyen 127 which refers to claiming incentives under section 127 of the income tax act ita 1976. Iv the aggregation of total income can be made with one wife only. Incentive under section 127 refers to the income tax act 1976.