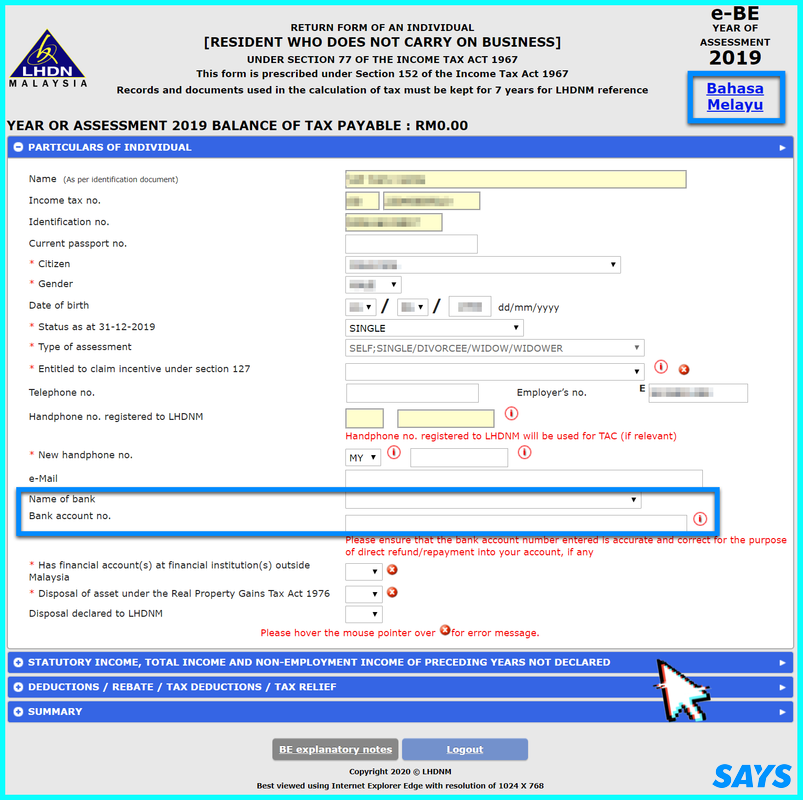

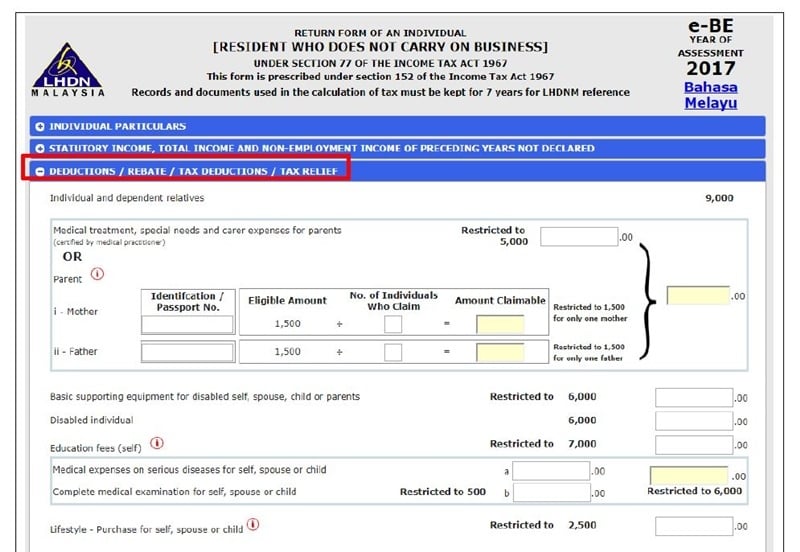

Entitled To Claim Incentive Under Section 127

A7 entitled to claim incentive under section 127 refers to incentives for example exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1967 entitled to be claimed as per the government gazette or minister s approval letter.

Entitled to claim incentive under section 127. In the same page there is an item called entitled to claim incentive under section 127 which refers to claiming incentives under section 127 of the income tax act ita 1976. A8a entitled to claim incentive under section 127 refers to incentives for example exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1967 entitled to be claimed as per the government gazette or minister s approval letter. Type of incentives a incentive for ohq an approved ohq company is eligible for income tax exemption for a period of 10 years under section 127 income tax act 1967 for income derived from the following sources. Claim incentive under section 127 for example exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1967 entitled to be claimed as per the government gazette or minister s approval letter.

This is incentives such as exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1976 which is claimable as per government gazette or with a minister s approval letter. There will also be a layak menuntut insentif dibawah seksyen 127 which refers to claiming incentives under section 127 of the income tax act ita 1976. Business income income arising from services rendered by an ohq company to its offices or related companies.

I enter x in the box for the type s of incentive entitled to be claimed for. In pn 2 2018 the irb clarifies that the scope of exemption granted. Section 127 is to be covered. 1 paragraph 127 3 b of ita 1967.

A7 entitled to claim incentive under section 127 2 approved donations gifts contributions 7 gift of money to an approved fund gift of money for any sports activity approved f8 lifestyle 13 f9 purchase of breastfeeding equipment for own 14 use for a child aged 2 years and below.