Example Of Direct Tax In Malaysia

Inland revenue board of malaysia loan or advances to director by a company public ruling no.

Example of direct tax in malaysia. 30 november 2015 contents page 1. Type of indirect tax. Income tax rpgt stamp duty and petroleum income tax. Example of direct tax.

Types of taxes in malaysia direct taxes paid directly by those on whom it is levied. Tax treatment 2 5. Your income tax number consists of a tax reference type of 1 or 2 letter code followed by a 10 or 11 digit tax reference number. The most common tax reference types are sg og d and c.

Sales tax service tax and gst. The statutory body who is in charged with the direct tax is the malaysia inland revenue board lhdn. Interest income computation on loan or advances to directors of the company 8 6. A public ruling is published as a guide for the public and officers of the inland revenue board of malaysia.

Section 138a of the income tax act 1967 ita provides that the director general of inland revenue is empowered to make a public ruling in relation to the application of any provisions of the ita. Sales tax and service tax were implemented in malaysia on 1 september 2018 replacing goods and services tax gst. 8 2015 date of publication. Lembaga hasil dalam negeri malaysia classifies each tax number by tax type.

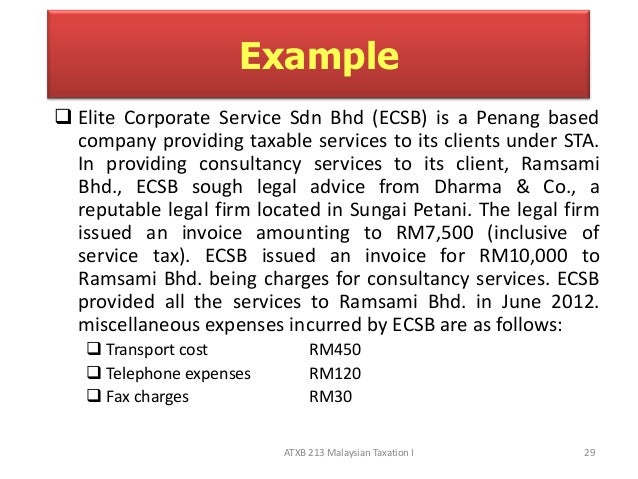

A direct tax is a tax that is levied on a person or company s income and wealth. Assist in applying for indirect tax exemption including making presentation to customs malaysian investment development authority mida and or mof. 10 for sales tax and 6 for service tax. Atxb213 malaysian taxation i 8 9.

Relevant provisions of the law 1 3. The tax is paid directly to the government. Sg 12345678901 tax reference. The inland revenue board of malaysia malay.

Indirect taxes collected via third party. Meanwhile indirect tax is referred to as tax. Price control and anti profiteering pcap conduct training for businesses on the pcap regulations and the impact it may have in determining pricing policy. What supplies are liable to the standard rate.