Hire Purchase In Malay

A hire purchase arrangement is often commonly referred to as a car loan.

Hire purchase in malay. Hire purchase hp or leasing is a type of asset finance that allow firms or individuals to possess and control an asset during an agreed term while paying rent or instalments covering depreciation of the asset and interest to cover capital cost. Pelanggan yang dihormati sehubungan dengan pengumuman bnm yang dibuat pada 30 apr 2020 mengenai operasionalisasi pembelian sewa dan kadar tetap islam fina. Read on for more information. A simple and straightforward car loan from bsn pay a deposit you can afford then pay the balance over the next few years.

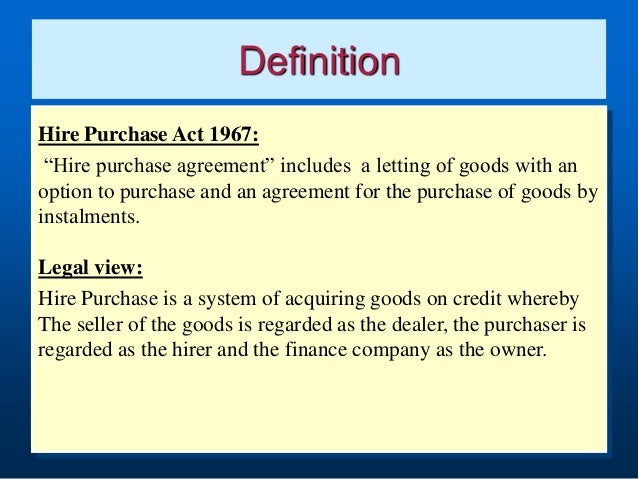

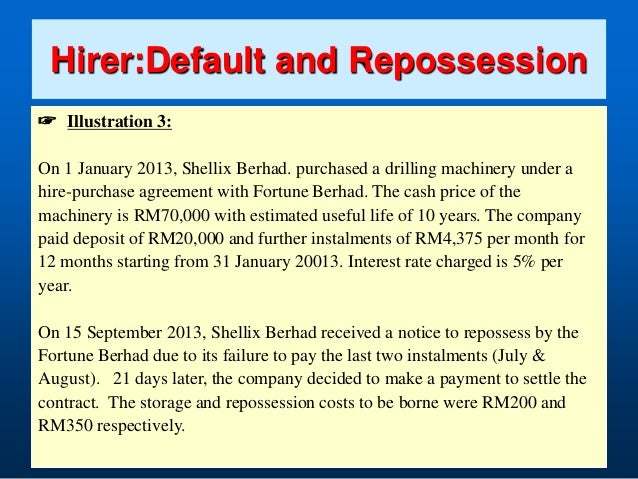

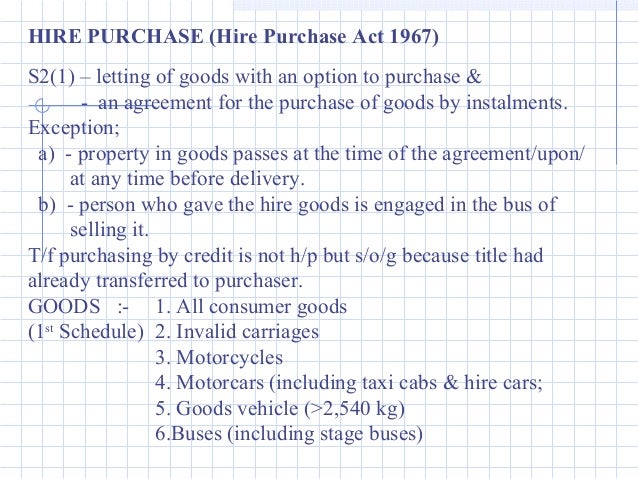

In malaysia hire purchase transactions are governed by the hire purchase act 1967. Buying a car under hire purchase is one of the most common ways to own a car. Do we know our rights under hire purchase laws. Read more apply now.

Hp is the hiring of goods with the option to buy the goods at the end of the hire purchase term. Monthly repayment rm 563 75. Interest rate 2 55 p a. But as we put our signature to the agreement do we really know what we are signing.

Anyone who owns a car will have come across hire purchase or financing for ownership. The notice shers in relation to bnm s announcement made on 30 apr 2020 on the operationalization of hire purchase and islamic fixed rate fina malay rm0 00 mbsb bank. In malaysia hire purchase is governed by the hire purchase act 1967 hp act. This booklet provides the basics explains the common terms used in hire purchase agreement and gives some tips on hire purchase financing.

Learn more in the cambridge english malay dictionary. Borrowing rm 30000 over 5 years.