Islamic Finance In Malaysia Growth Development

An important part of this will be the internationalisation of islamic finance and the development of malaysia as an international islamic financial centre.

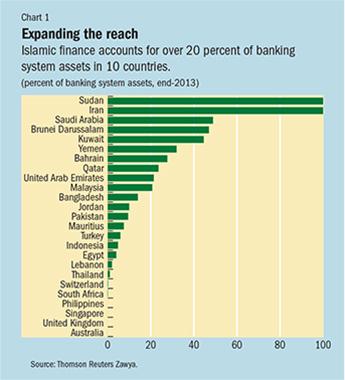

Islamic finance in malaysia growth development. By 2015 the industry had surpassed us 1 88 trillion in size. Islamic finance has emerged as an effective tool for financing development worldwide including in non muslim countries and may prove to be an important contributor towards realizing the sdgs. Recently with support from the world bank malaysia launched a new initiative that addresses both these principles. A global growth opportunity amidst a challenging environment governor s keynote address at state street islamic finance congress 2008 boston 6 october 2008.

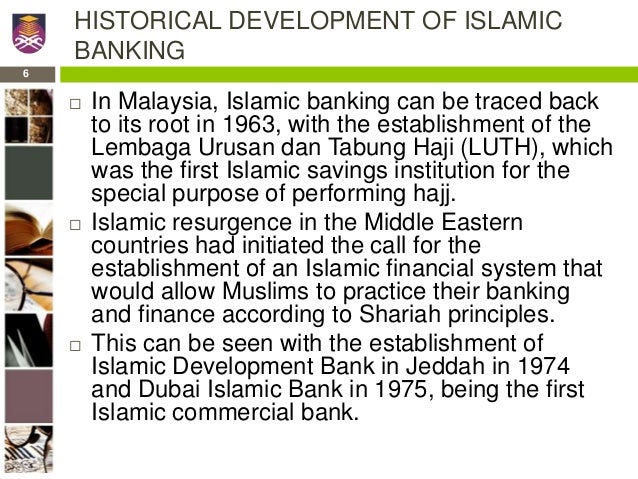

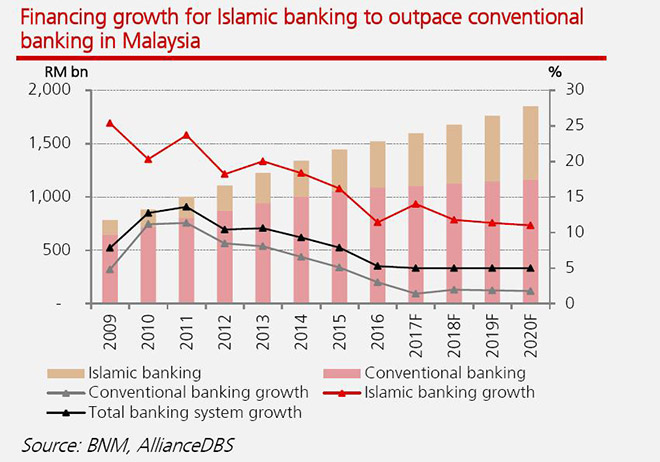

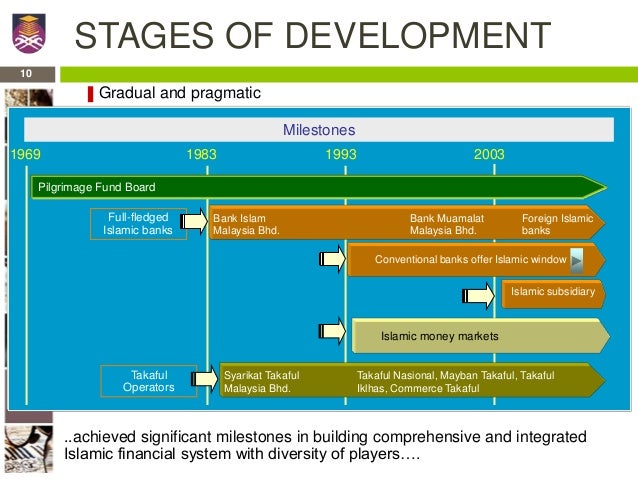

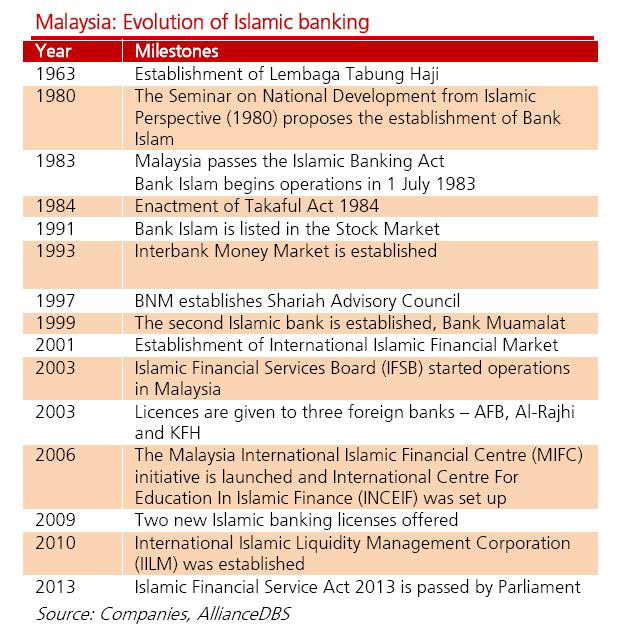

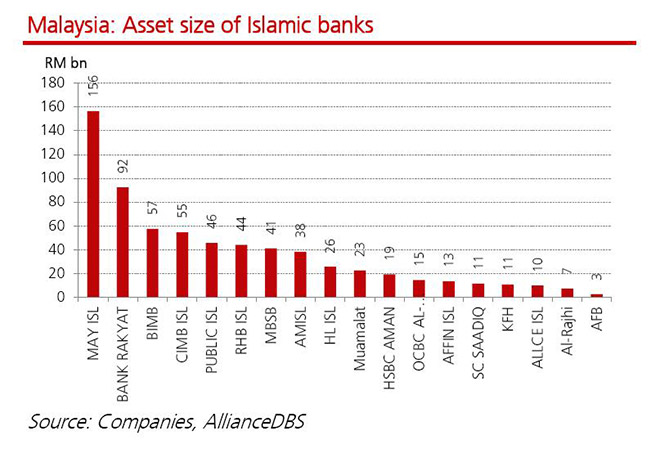

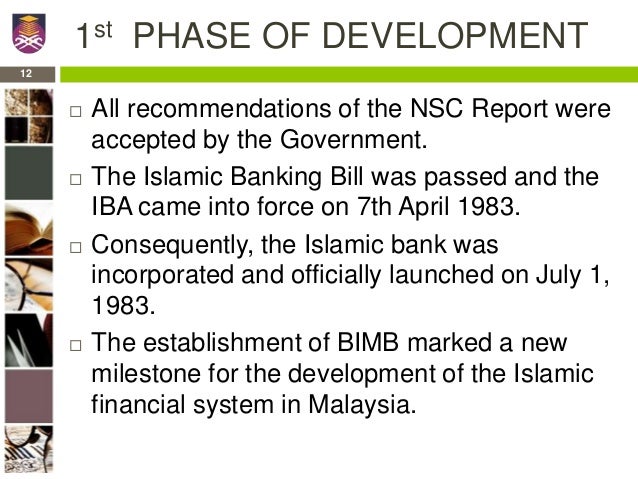

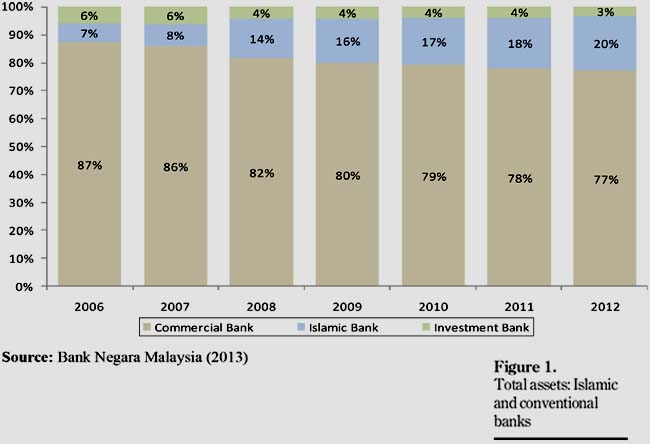

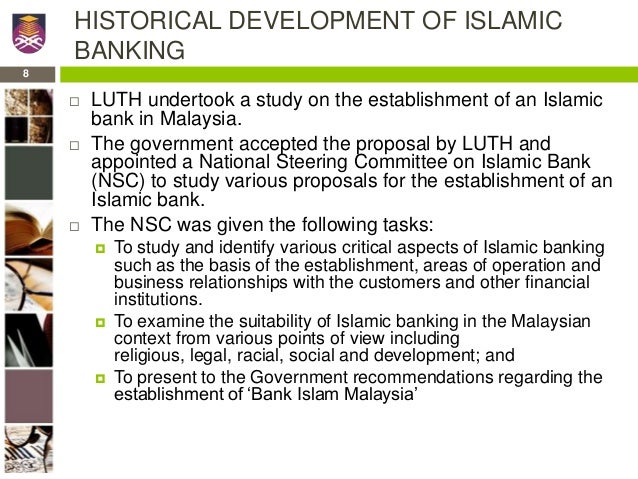

The islamic finance industry in malaysia is characterised by having comprehensive market components ranging from islamic banking takaful islamic money market and islamic capital market. It plays an important role in generating economic growth for the country. From a market share of 5 3 in 2000 islamic financing now accounts for 34 9 of total loans and financing. Islamic finance development development of the islamic banking sector creating an impact on society and economy through value based intermediation vbi the islamic banking industry in malaysia has advanced significantly over the years.

Zeti akhtar aziz islamic finance. Malaysia has recorded 17 3 growth of islamic finances market between 2009 2014 mifc 2015a. The recommendations in the blueprint are focused on nine major areas supported by 69 recommendations and more than 200 initiatives. Financing sustainable climate resilient growth.

The icm is a component of the overall capital market in malaysia. The icm functions as a parallel market to the conventional capital market and plays a complementary role to the islamic banking system in broadening and deepening the islamic financial markets in malaysia. When islamic finance shot to prominence in 2008 performing well even during the global downturn the investment community started taking notice. Support islamic financing growth in the near term.

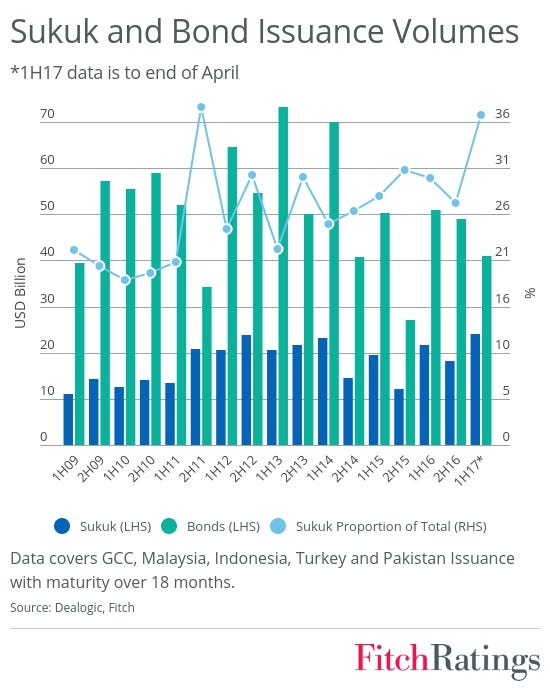

According to ram ratings malaysia was the top sukuk issuer with us 13 9 bil ringgit equivalent or 35 1 of the us 39 5 bil ringgit equivalent sukuk issued in the first quarter ended march 31 2019. Malaysia has extensive experience in using islamic financial instruments to support infrastructure development the data shows 61 of the world s infrastructure sukuk was issued out of malaysia 4 and the global infrastructure investment index 2016 ranks malaysia as the second most attractive destination for infrastructure investment in asia and fifth in the world.