Malaysia 3 Month Treasury Bill Rate

Current 3 month treasury rate is 0 09 a change of 0 00 bps from previous market close.

Malaysia 3 month treasury bill rate. The 3 month treasury bill rate is the yield received for investing in a government issued treasury security that has a maturity of 3 months. 3 months data was reported at 3 269 pa in sep 2018. Bnm overnight policy rate opr w e f apr 26 04 p a. The yield on a treasury bill represents the return an investor will receive by holding the bond to maturity.

This page provides malaysia 3 month t bill historical data malaysia 3 month t bill chart malaysia 3 month t bill widgets and news. This records an increase from the previous number of 3 250 pa for aug 2018. Bills are sold at discount through competitive auction facilitated by bank negara malaysia with original maturities of 3 month 6 month and 1 year. Interbank rate in malaysia averaged 3 99 percent from 1993 until 2020 reaching an all time high of 14 50 percent in july of 1997 and a record low of 1 95 percent in october of 2020.

Malaysian treasury bills mtb short term securities issued by bank negara malaysia bnm for the government s working capital requirements. Malaysian treasury bills mtb mtb are short term securities issued by the government of malaysia to raise short term funds for government s working capital. Malaysia three month interbank rate was at 1 95 percent on friday october 30. Secondary market bills 3 month h 15 selected interest rates treasury interest rate interest board of governors rate monthly nation public domain.

Malaysia 3 month t bill is a debt obligation issued by malaysia government maturing in 3 months. This page provides malaysia three month interbank rate actual values historical data forecast chart statistics economic. Mtb are issued with original maturities of 3 month and 6 month and 1 year. Interbank rate 3 month p a.

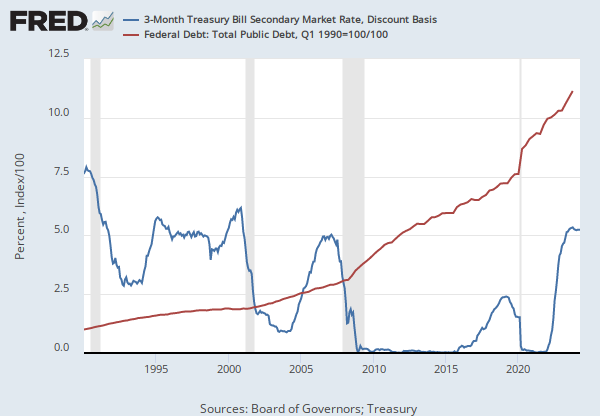

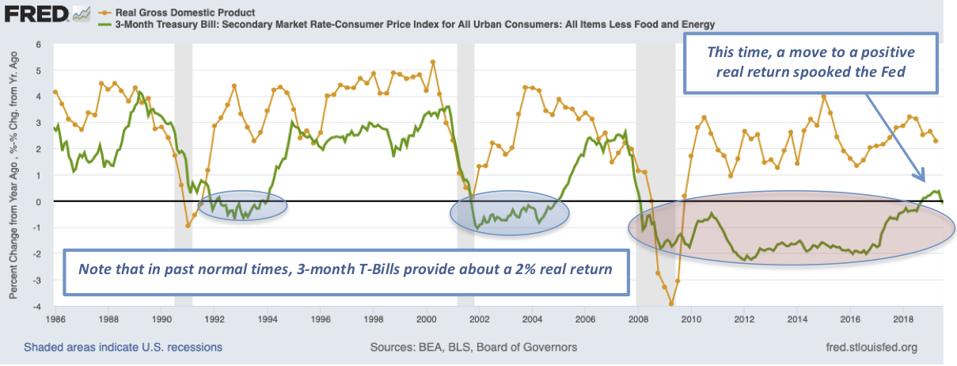

Sep 20 market indicative yield on 5 year federal government securities p a. Citation requested not seasonally adjusted united states of america. The 3 month treasury yield is included on the shorter end of the yield curve and is important when looking at the overall us economy. The data reached an all time high of 9 982 pa in jun 1998 and a.

Malaysia and bank negara malaysia. Stay on top of current and historical data relating to malaysia 3 month bond yield. 3 month treasury rate table by month historic and current data.