Maybank Islamic Housing Loan

Minimal documentation compared to other home financing plans.

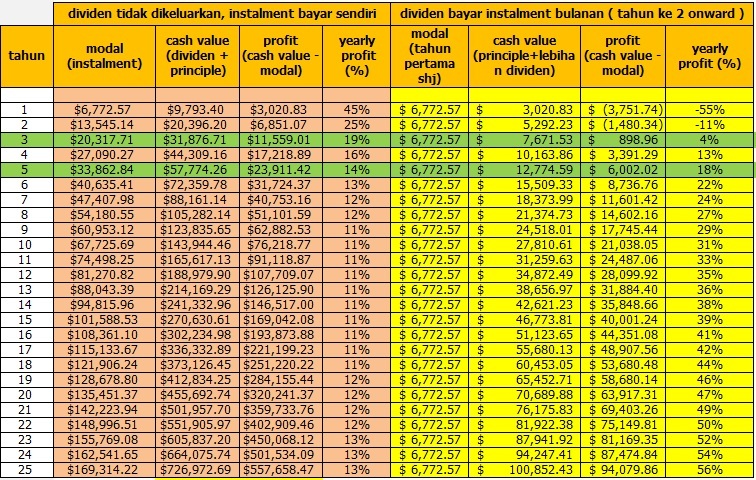

Maybank islamic housing loan. Working capital guarantee scheme i wcgs i to assist viable smes to gain access to working capital financing from the participating financial institutions pfis with the guarantee coverage provided by the malaysian government. Receive cash rebate when you refinance your existing home loan to us. Maybank commodity murabahah home financing i is a variable rate shariah compliant home financing plan based on the concept of commodity murabahah arrangement i e. Select one asb asb 2 financing car financing cash line facility overdraft islamic financing mortgage personal loans share margin financing skim amanah rakyat 1malaysia sara 1malaysia skim prihatin pendidikan 1malaysia spp1m term loans pr1ma home financing.

Public islamic bank home loan. Unlock the value of your private property. Maybank islamic offers a comprehensive variety of shariah compliant islamic home financing packages with fixed variable rates to choose from with and without lock in periods. Is a maybank islamic home loan right for me.

Home loans islamic financing islamic financing show. Contact us to enjoy interest savings. One of it is the maybank home loan calculator. A cost plus profit concept.

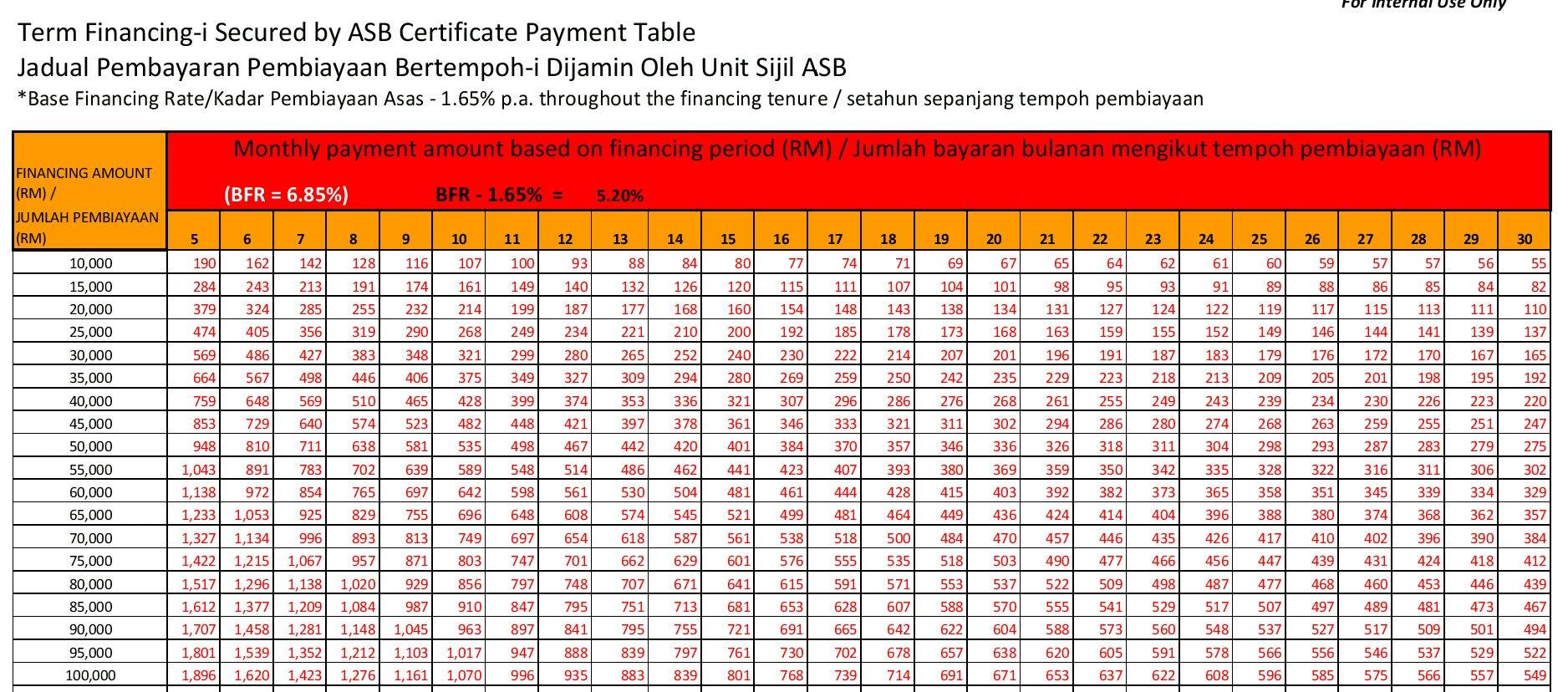

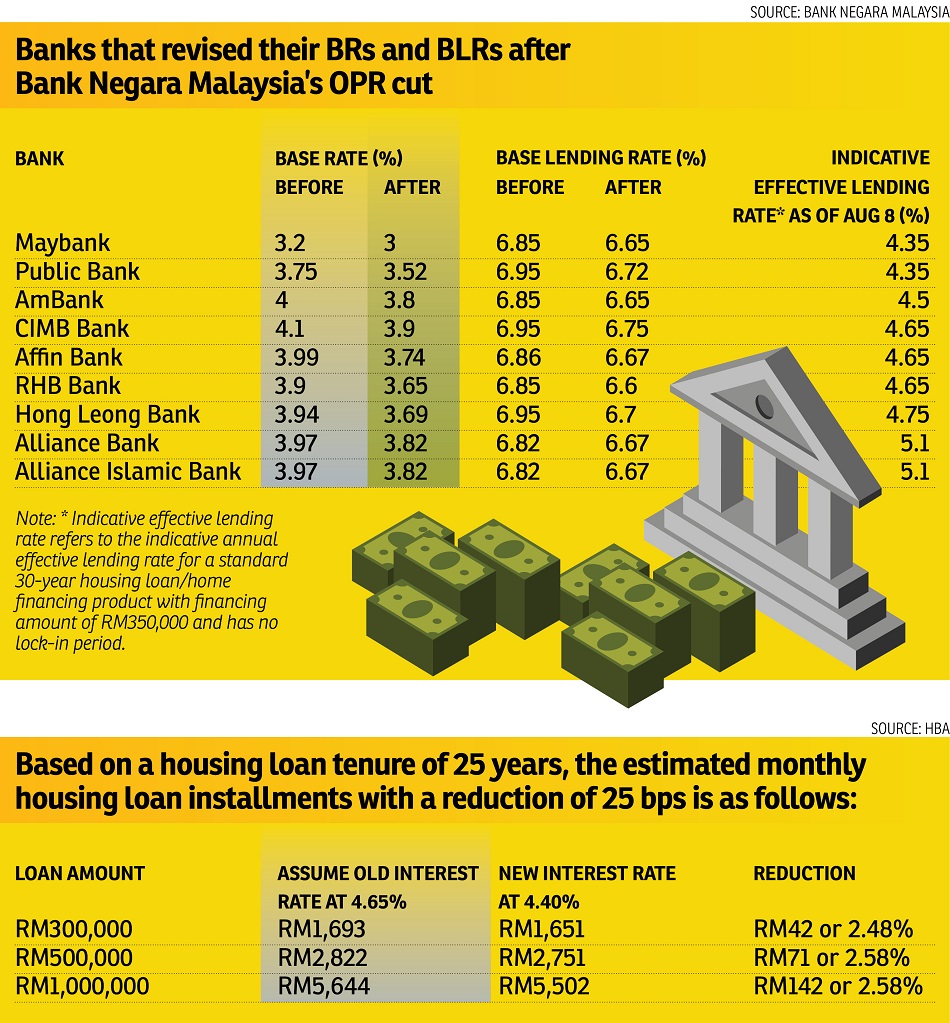

Maybank home loans are applicable to singapore property financing in singapore dollars only. Flexi loan new base rate 3 25 interest rate 4 55 br 1 30 lock in period none. Flexi loan new base rate 3 52 interest rate 4 62 br 1 10 lock in period 3. Maybank fixed rate and floating rate home loans are pegged to the home loan board rates known as singapore residential financing rate srfr singapore residential financing rate 2 srfr2 or fixed deposit mortgage rate 36 fdmr36.

Maybank islamic home loan. Technically maybank provides home financing to you via trading of shariah compliant commodities such as crude palm oil and rbd palm olein. Up to 75 financing. Competitive housing loan interest rate packages.