Mbsb Mumtaz I Personal Loan

Type in 100000 and not 100 000.

Mbsb mumtaz i personal loan. Being an unsecured islamic personal loan mbsb mumtaz i comes with variable profit rate and optional takaful coverage. Mbsb mumtaz i is one of the personal financing plans from mbsb bank berhad. One can loan a maximum of rm 250 000 for mumtaz i. The requirement of rm3 000 monthly minimum wages is a bit high for most.

Oleh itu anda tidak perlu ragu ragu untuk mohon pembiayaan ini. Pelan pembiayaan peribadi mbsb ini adalah pelan pinjaman islamik yang sepenuhnya patuh syariah dengan berasaskan konsep komoditi murabahah. Mbsb mumtaz i is a personal loan that is catered for borrowers from public servant which consists of selected permanent gcls and government servants. This islamic personal loan pinjaman peribadi mumtaz i.

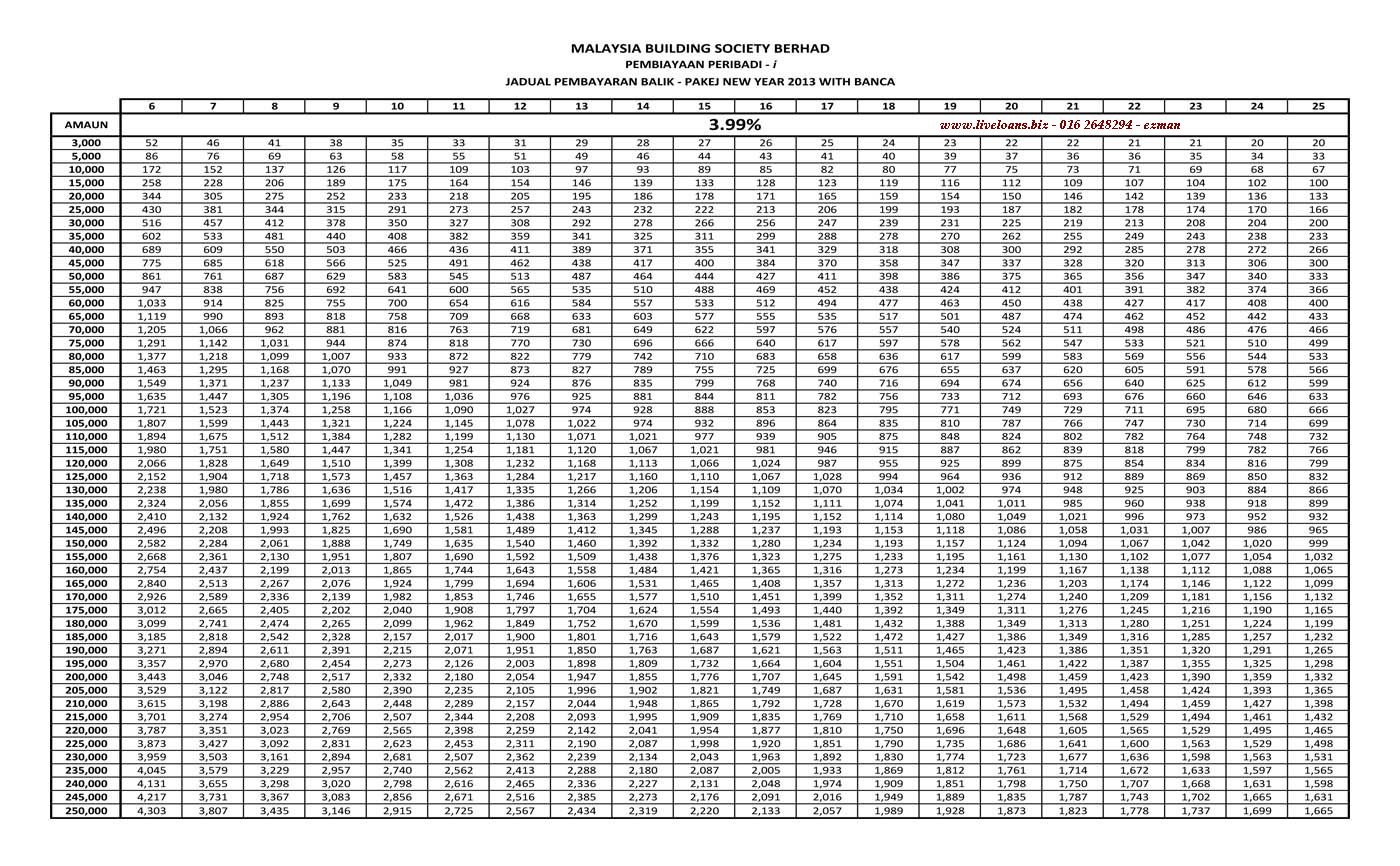

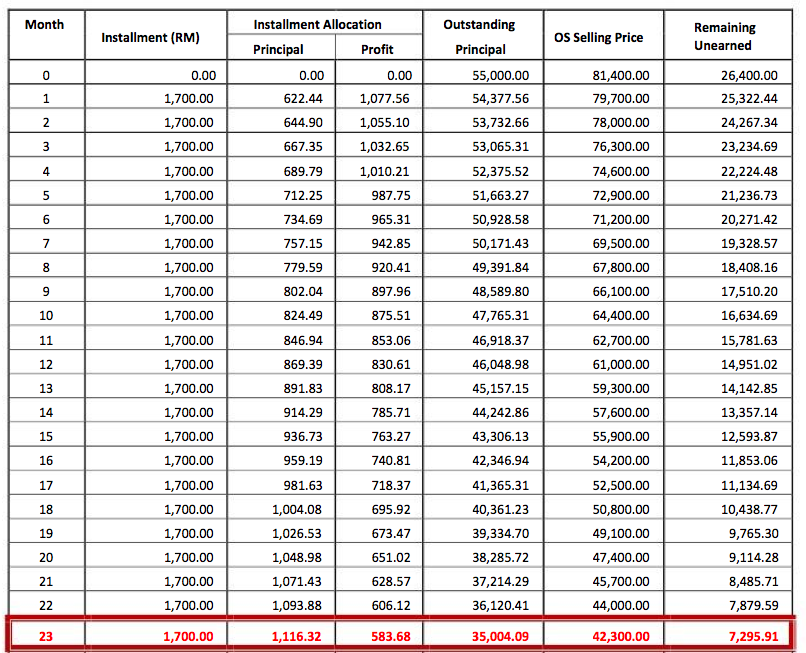

Lot r 01 01 r 01 02 emira d kayangan seksyen 13 40100 shah alam selangor. Complete the fields below to determine your monthly instalments for your personal financing i. Mbsb personal financing mumtaz i is a shariah compliant personal financing that follow the islamic contract of tawarruq with profit rate calculated on a floating and monthly rate basis. Who can apply for mbsb personal financing mumtaz i.

This personal loan is shariah complaint with no requirements for guarantor and collateral. How much should you be paying for your personal financing i. Loan tenure year s monthly income. Islamic government servant personal loan mbsb mumtaz i apply now 3 69 4 00 profit rate.