Mbsb Mumtaz I

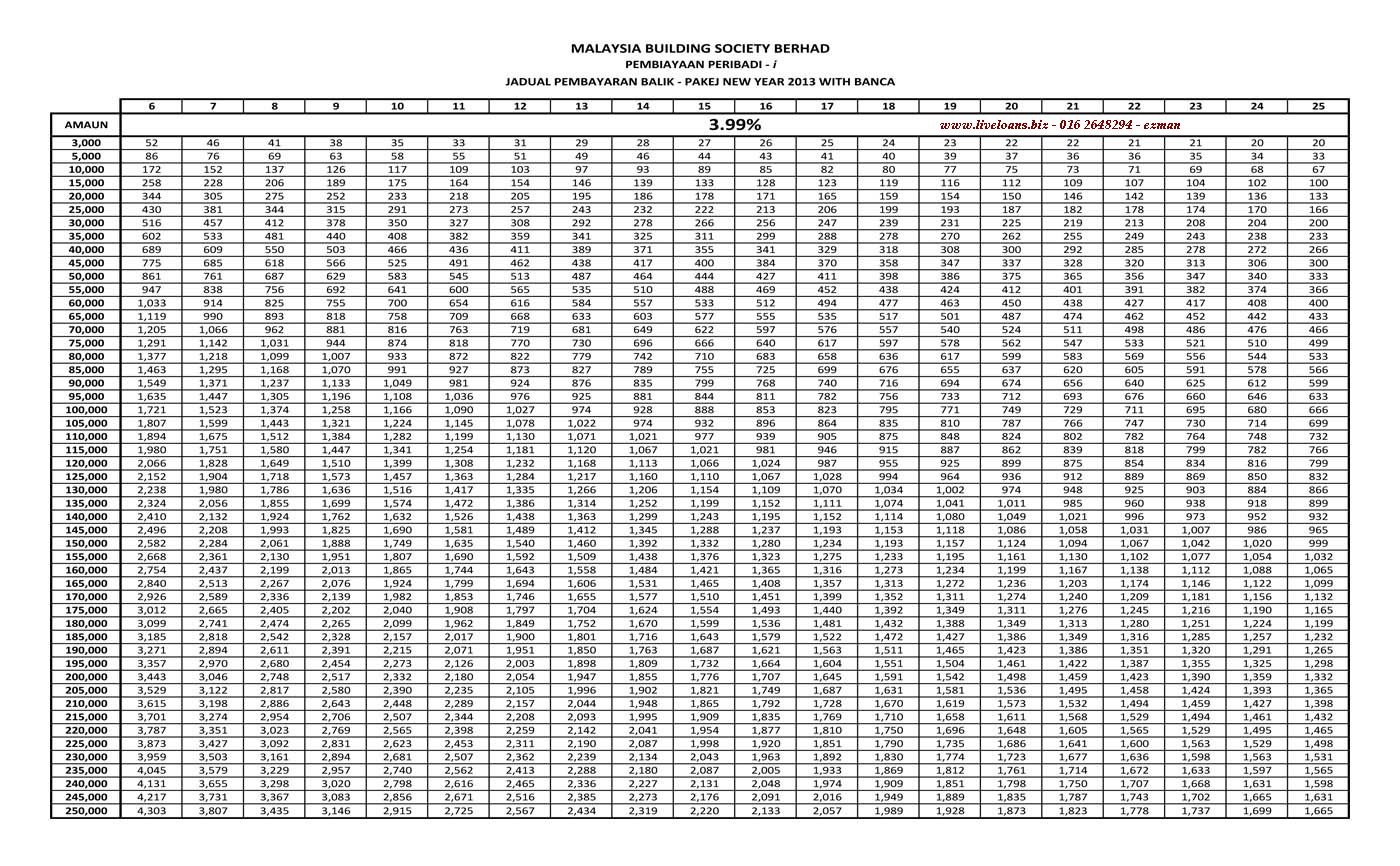

Financing amount of up to rm250 000 for a maximum loan tenure of 10 years.

Mbsb mumtaz i. Mbsb mumtaz i is a personal loan that is catered for borrowers from public servant which consists of selected permanent gcls and government servants. Mbsb mumtaz i faq what is the maximum amount you can finance. One can loan a maximum of rm 250 000 for mumtaz i. The requirement of rm3 000 monthly minimum wages is a bit high for most.

Mbsb personal financing mumtaz i is a shariah compliant personal financing that follow the islamic contract of tawarruq with profit rate calculated on a floating and monthly rate basis. Mbsb bank berhad has been granted a license by bank negara malaysia to undertake islamic banking business. Applicant must not exceed the age of 60 at the end of the financing tenure. Mbsb mumtaz i is one of the personal financing plans from mbsb bank berhad.

This personal loan is shariah complaint with no requirements for guarantor and collateral. Pemohon tidak boleh melebihi umur 60 tahun di akhir tempoh pinjaman. This islamic personal loan. Malaysia building society berhad mbsb is the financial holding company of mbsb bank berhad formerly known as asian finance bank berhad.

Mbsb bank is regulated and supervised by bank negara malaysia under the islamic financial services act 2013. Pelan pembiayaan peribadi mbsb ini adalah pelan pinjaman islamik yang sepenuhnya patuh syariah dengan berasaskan konsep komoditi murabahah. Sepertimana namanya mumtaz bermaksud terbaik atau nombor satu dalam bahasa arab pinjaman peribadi mumtaz i mbsb ini menawarkan antara kadar faedah terbaik untuk kakitangan kerajaan kerajaan dan glc dari serendah 3 4 setahun sehingga 3 8 setahun bergantung kepada jumlah dan tempoh pinjaman. Pemohon adalah warganegara malaysia berumur antara 19 hingga 60 tahun untuk layak.

Applicant must be a malaysian citizen between the age of 19 to 60 to qualify. Who can apply for mbsb personal financing mumtaz i. Mbsb bank is regulated and supervised by bank negara malaysia under the islamic financial services act 2013. Being an unsecured islamic personal loan mbsb mumtaz i comes with variable profit rate and optional takaful coverage.

Mbsb personal financing mumtaz i adalah pelan pembiayaan peribadi yang ditawarkan oleh mbsb bank berhad. Oleh itu anda tidak perlu ragu ragu untuk mohon pembiayaan ini.

.jpg)