Monetary Policy In Malaysia Covid 19

Small debt resolution scheme transferred to akpk the small debt resolution scheme sdrs.

Monetary policy in malaysia covid 19. At its meeting today the monetary policy committee mpc of bank negara malaysia decided to reduce the overnight policy rate opr by 25 basis points to 2 50 percent. Kuala lumpur march 18 central banks monetary policy and governments fiscal policy can be two essential weapons for the asean economies to use to manoeuvre against a potential recession caused by the covid 19 outbreak and plunging oil prices according to an economist. Following this economists generally agree that economic policy should focus mainly on bolstering public health efforts in handling the pandemic whilst ensuring the welfare of the rakyat and businesses. Bank negara malaysia and the malaysian financial industry are committed to assist individuals and viable businesses adversely affected by the covid 19 pandemic.

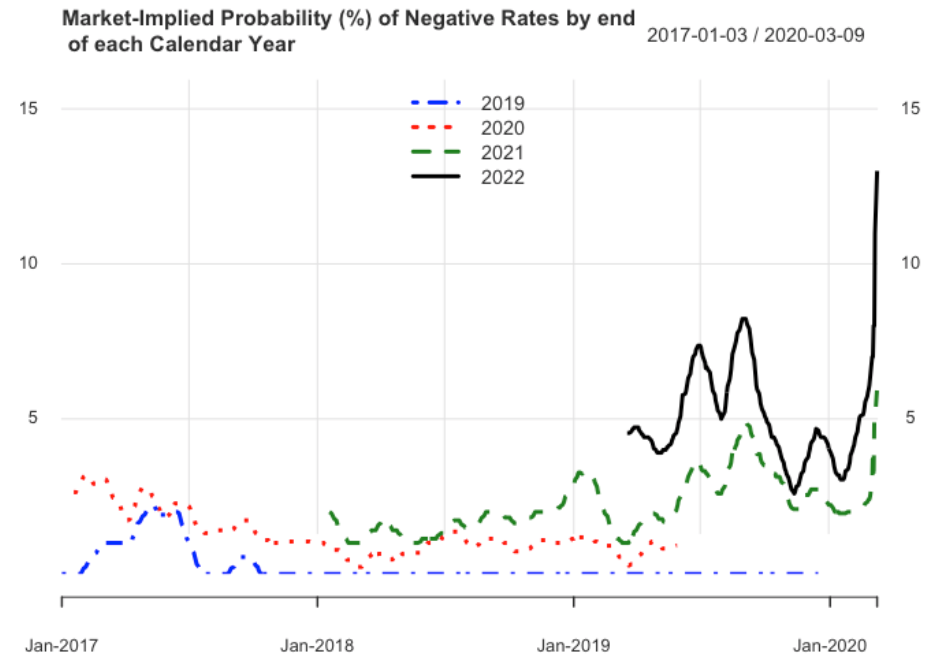

In times of pandemic fiscal policy is key to save lives and protect people. Bank negara malaysia has ample room for monetary policy adjustments as the country braces for the impact from the covid 19 coronavirus outbreak. The ceiling and floor rates of the corridor of the opr are correspondingly reduced to 2 75 percent and 2 25 percent respectively. Governments have to do whatever it takes.

Guidance on safe distancing measures for issuers when conducting meetings. Français 日本語 português русский. Unlike the global financial crisis in 2008 and the asian financial crisis in 1997 malaysia s covid 19 crisis is a public health crisis first and an economic crisis second. Monetary policy statement on 10 sep 2020.

Comments by mas on covid 19 temporary measures bill. Kuala lumpur march 16 the government may introduce additional monetary policy and fiscal stimulus soon to cushion the economy from any downside risks associated with the covid 19 outbreak according to analysts. Acra mas sgx update guidance on general meetings. Measures to address covid 19 impact.

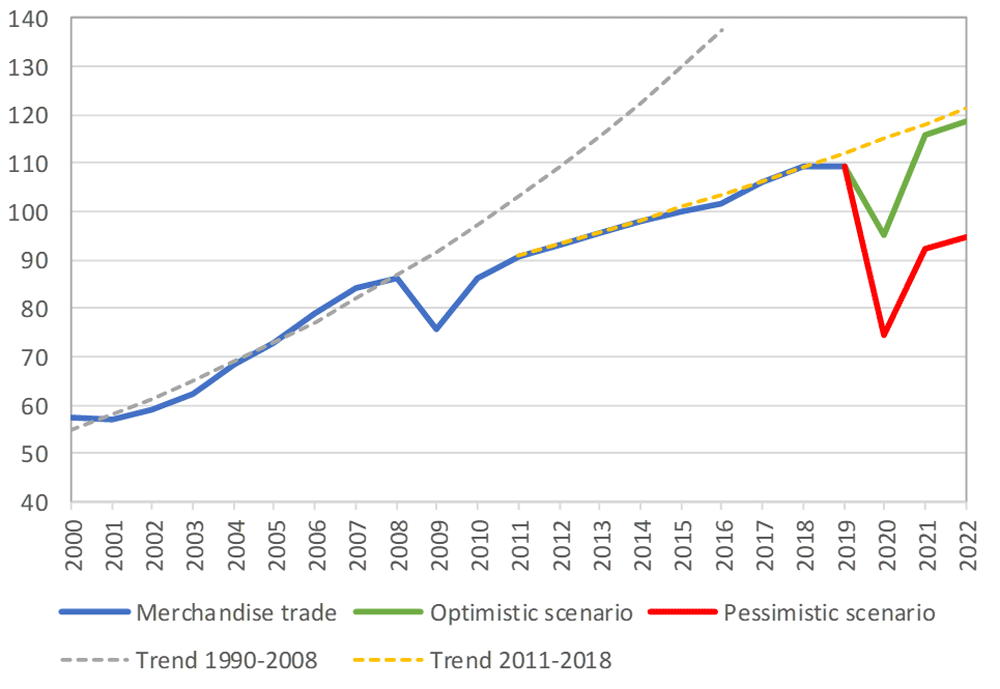

Imfblog is a forum for the views of the international monetary fund. Fiscal policies to contain the damage from covid 19. The possibility could not be discounted as the country s economic outlook is. Rich countries have introduced massive health and public spending programs to counter the economic effects of the covid 19 pandemic.

But they must make sure to keep.