Quit Rent And Assessment In Malay

Often too late that they find to their dismay that they have to pay a form of penalty down the road.

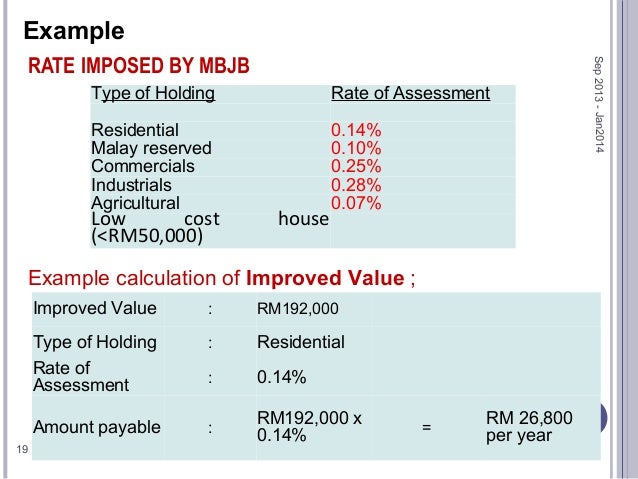

Quit rent and assessment in malay. What is the difference between tax assessment and land tax. Assessment rates or cukai pintu is a local land tax collected by local councils to pay for developing and maintaining local infrastructure and services. One important cost many new property owners tend to neglect is the land taxes that must be paid to the local authorities each year. This is because the specified rate differs from one state to another so a 2 500 sq ft home in penang can either be cheaper or more expensive than an identical unit in kedah.

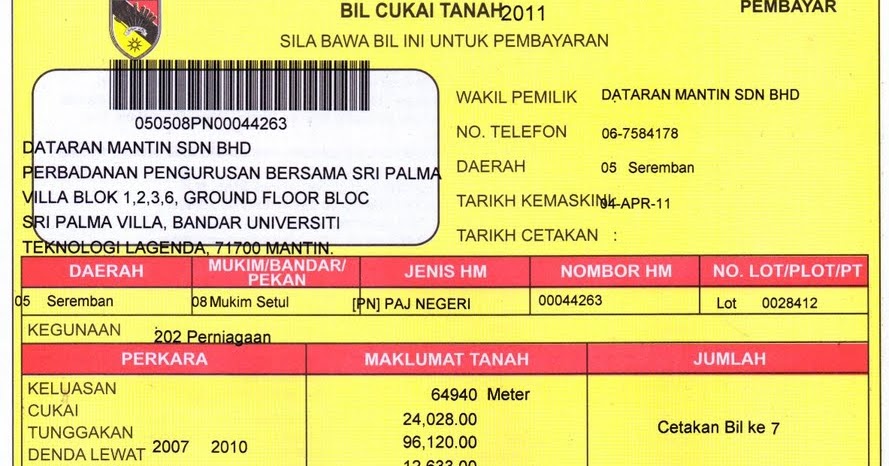

Referred to as cukai tanah in malay quit rent is the payment that owners of local properties make to the malaysian government through the land office or pejabat tanah dan galian ptg. This system only persists in malaysia in the 21st century. Quit rent or cukai tanah is a form of land tax collected by your state government for property in malaysia. Quit rent cukai tanah is a tax imposed on private properties.

Assessment tax is unique to malaysia. Tax assessment also known as quit rent is paid to local authority and is paid every half a year. The tax assessment bill is blue in colour land tax is imposed to land owners and is paid to state authorities once every year. In 1760 the colonial government passed a 10 year quit rent exemption on properties in the lake champlain area to encourage settlements in upstate new york and vermont.

The bill is yellow in colour. It may seem like a rather unusual term at first but quit rent is actually one of the most common and fundamental systems in malaysia s property scene. Contextual translation of quit rent assessment into malay. Managing your household finances is a big part of becoming an independent homeowner.

In malaysia land taxes come in the form of the quit rent parcel rent and. The quit rent for properties that are of the exact same size may not necessarily be the same across malaysia though. Property tax notis berhenti sewa. It must be paid by the landlord to the state authority via the land office and is payable in full amount from 1 st january each year and will be in arrears from 1 st june each year.