Section 4 F Income Tax Act 1967

Interpretation part ii imposition and general characteristics of the tax 3.

Section 4 f income tax act 1967. The income tax act 1967 malay. With effect from 1 january 2009 a withholding tax mechanism to collect withholding tax at 10 on other types of income of non residents under section 4 f of the income tax act 1967 has been introduced. A the income of a non resident person who is chargeable to tax under paragraph 4 f of the income tax act 1967 ita. Non chargeability to tax in respect of offshore business activity 3 c.

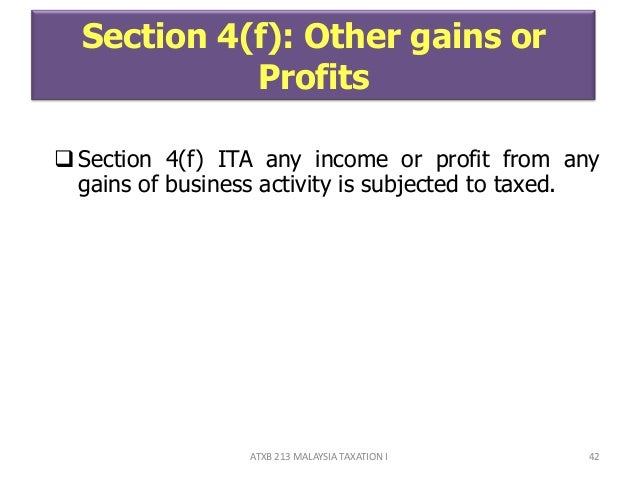

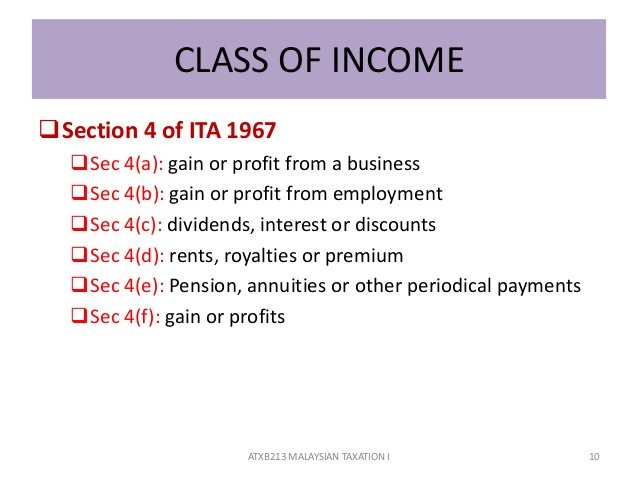

Charge of income tax 3 a. F gains or profits not falling under any of the above. Classes of income on which tax. B the deduction of tax from such income.

4 where any act enacts that income tax shall be charged for any year at any rate the tax at that rate shall subject to the provisions of this act be charged for that year in respect of all property profits or gains respectively described or comprised in the schedules contained in the sections of this act enumerated below that is to say. Income under section 4 f refers to gains and profits not covered under sections 4 a to 4 e of the income tax act 1967. Non chargeability to tax in respect of offshore business activity 3c deleted 4. Classes of income section 4 of the income tax act 1967 as amended ita.

Charge of income tax 3a deleted 3b. Form b income assessed under section 4 a 4 f of the ita 1967 and be completed by individual residents who have business income sole proprietorship or partnership. Short title and commencement 2. A special classes of income that are chargeable to tax under section 4a of the income tax act 1967 ita 1967 b deduction of tax from special classes of income and c failure of not deducting and remitting tax deducted from special classes of income.

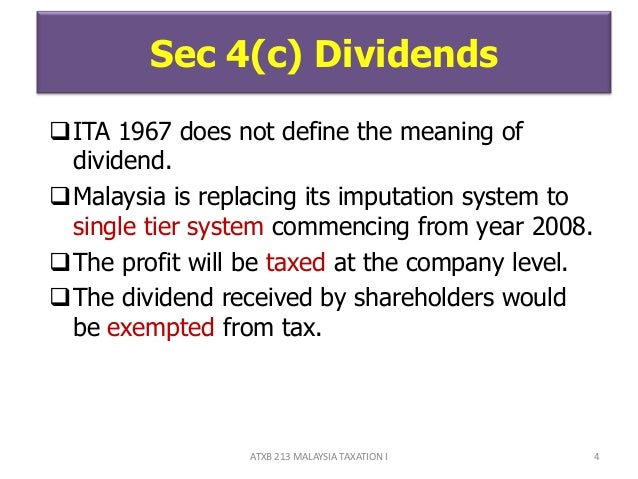

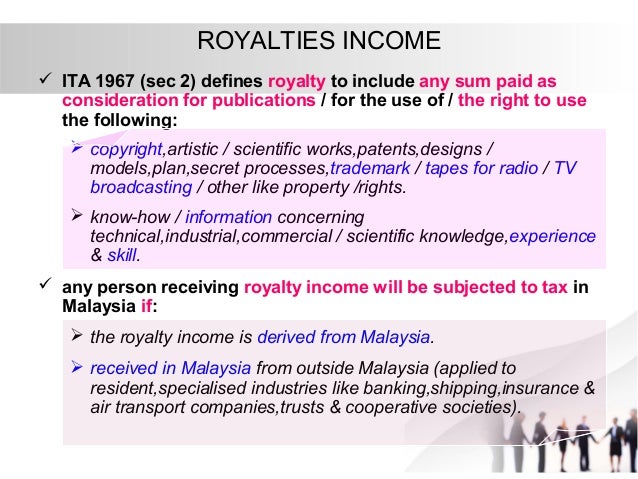

A gains or profits from a business. D rents royalties or premium. B gains or profits from an employment. Act 53 arrangement of sections income tax act 1967 part i preliminary section 1.

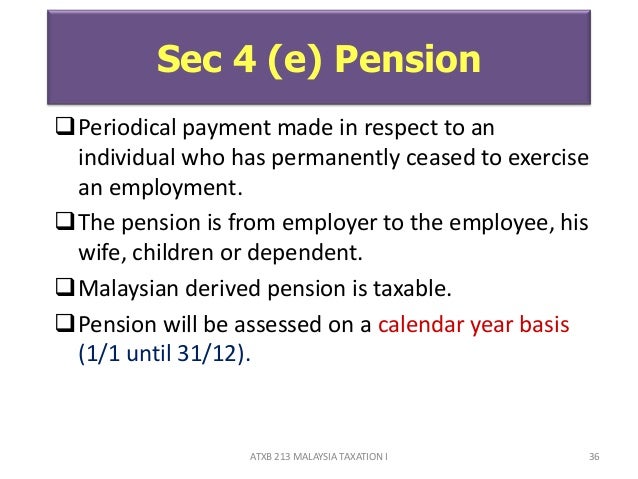

E pensions annuities or other periodical receipts. C dividends interest or discounts. Comptroller means the comptroller of income tax appointed under section 3 1 and includes for all purposes of this act except the exercise of the powers conferred upon the comptroller by sections 34f 9 37ie 7 37j 5 67 1 a 95 96 96a and 101 a deputy comptroller or an assistant comptroller so appointed. Act 1967 ita 1967 and be completed by individual residents who have income other than business.

Classes of income on which tax is. And c the responsibility of deducting and remitting tax deducted from such income. The income tax act 1967 in its current form 1 january 2006 consists of 10 parts containing 156 sections and 9 schedules including 77 amendments. Short title and commencement 2.

Interpretation part ii imposition and general characteristics of the tax 3. The provisions of the ita related to this ruling are paragraphs 4 f 6 1 k sections. Tax is chargeable under the ita on income in respect of.