Benefits Of Gst In Malaysia

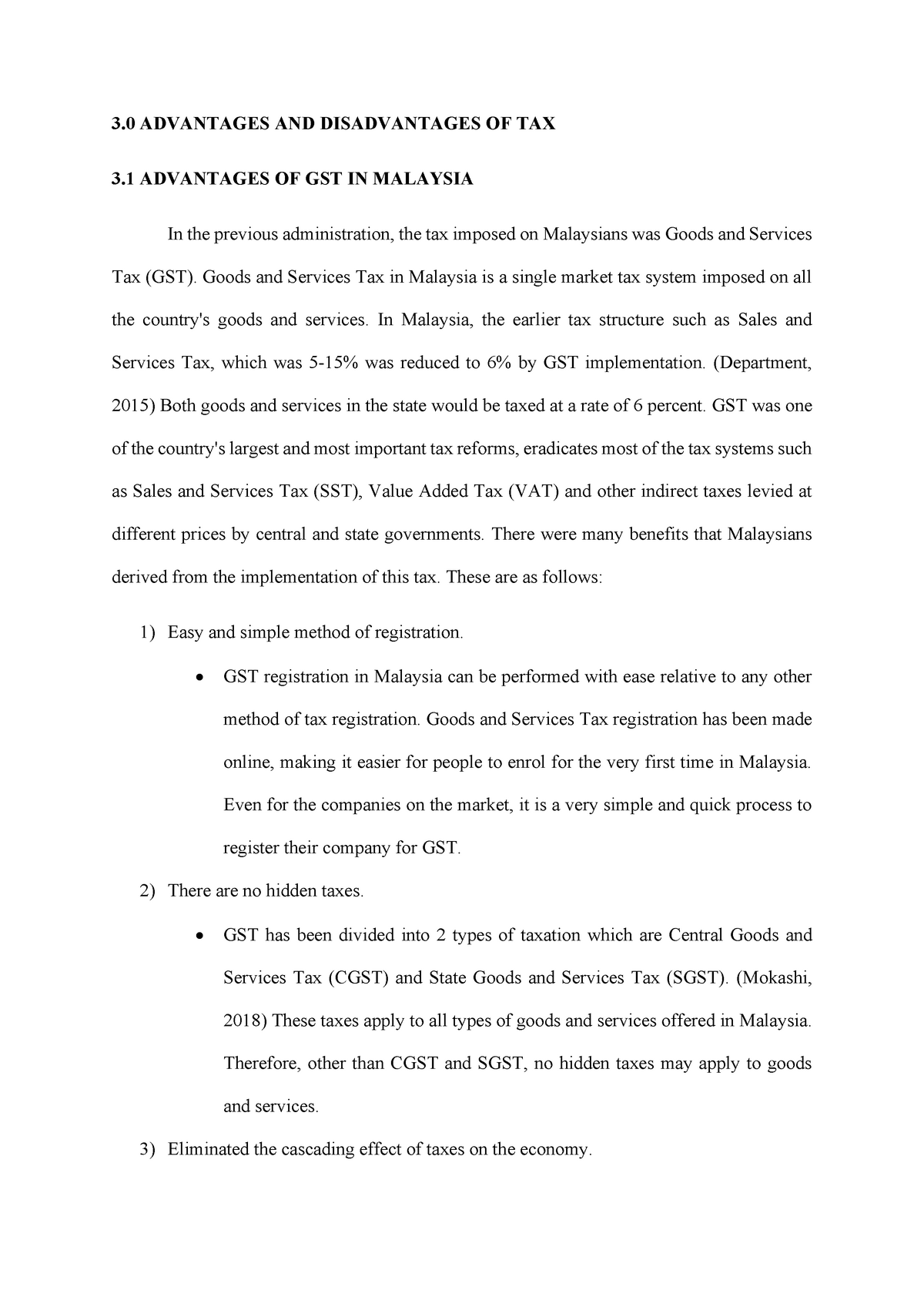

The gst is basically a form of taxation system imposed by the government where there is a single tax in the economy that is placed upon goods and services offered.

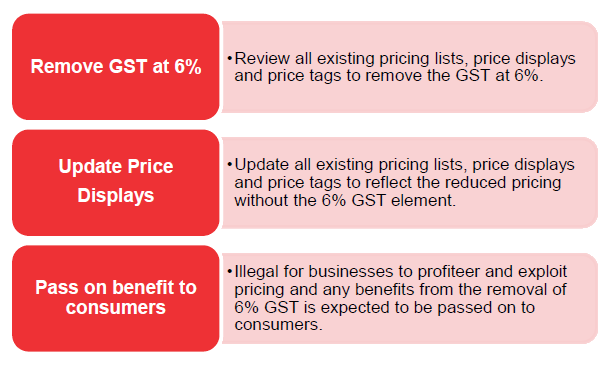

Benefits of gst in malaysia. With gst the government hopes to reduce the deficit to 2 8 3 by 2015. What other benefits can we expect from the introduction of gst. Without gst the malaysian government experiences a deficit of 5 of gdp. One of the government s budget objectives is to reduce the fiscal deficit by the implementation of the gst as the government revenue will be increased from the collection of the gst.

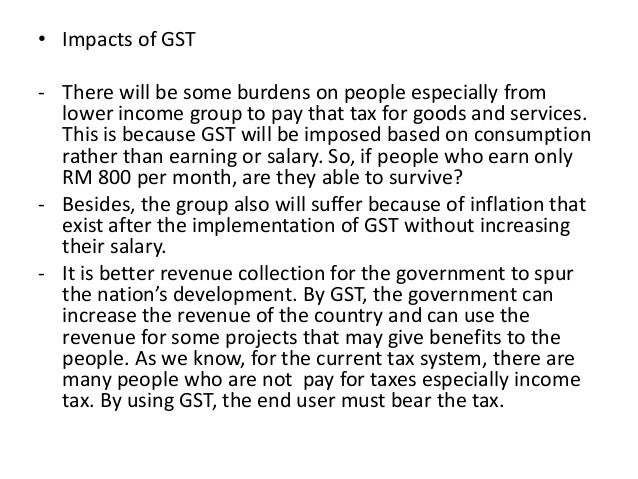

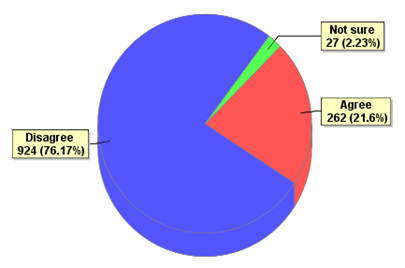

Gst is a transparent tax structure. Gst in malaysia is an ugly truth because the prices of consumer goods and services will increase in short term as well as in long term which might reduce consumer spending in the country. The tax reduction will take place once the government implements the long awaited goods and services tax gst he says. The advantages disadvantages of gst in malaysia.

The goods and services tax gst has been in effect for a while now in malaysia. It is more efficient than the other tax which sales and service tax sst. The finance ministry has come out with a list of 10 benefits of gst for the malaysian business sector and consumers. The 10 advantages of gst are.

Gst in malaysia might be a benefit or a burden to many malaysians. All these benefits provided by the implementation of gst could stimulate the economic growth and increase the competitiveness in the global market. There are some advantage and give the good effect to the society and country. The tax amount is clearly shown on the sales invoice.

It is a self assessment tax and there are penalties to ensure compliance.