Direct And Indirect Tax In Malaysia

Deloitte s indirect tax experts understand the nuances of regulations the importance of industry knowledge and the growing role of technology.

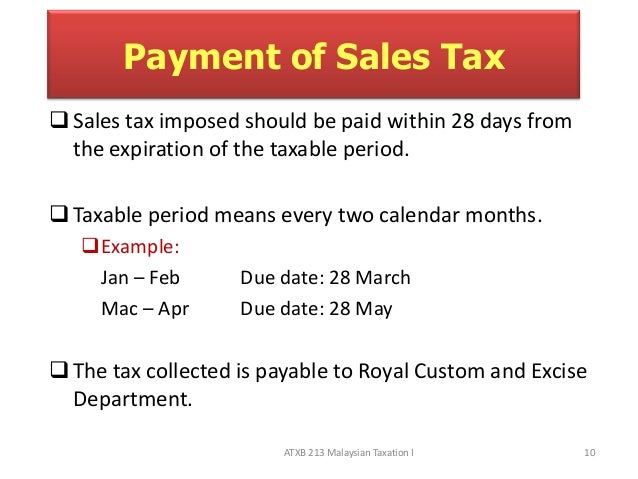

Direct and indirect tax in malaysia. 10 for sales tax and 6 for service tax. What supplies are liable to the standard rate. Kuala lumpur jan 20. The indirect tax landscape in malaysia is evolving at a fast pace.

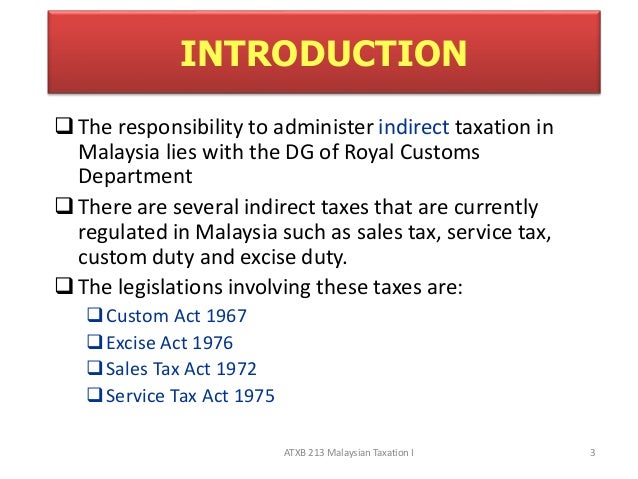

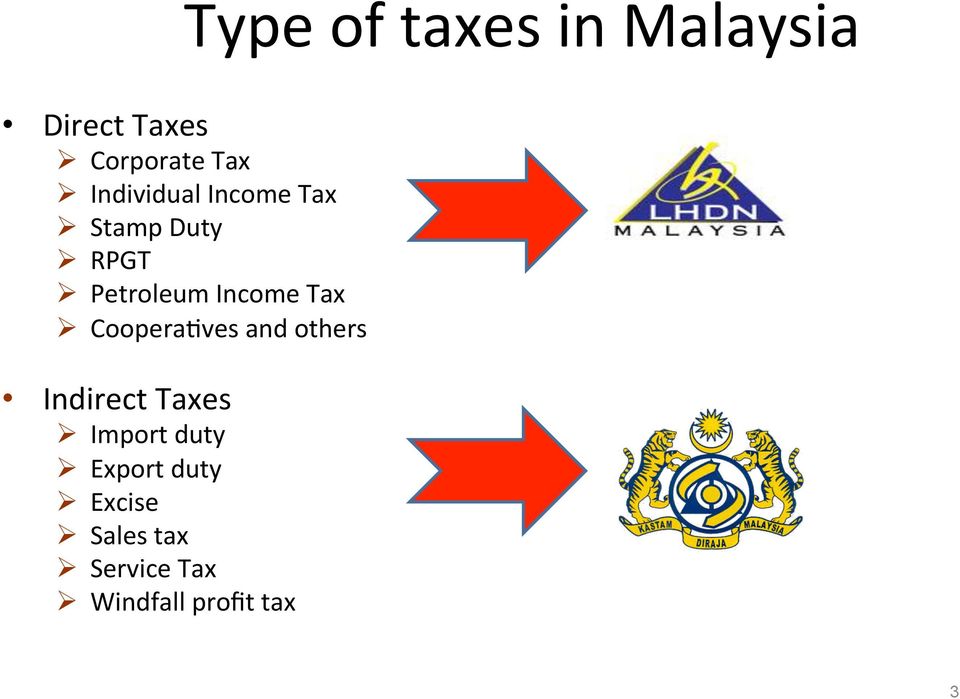

Direct taxes and indirect taxes a comparison between entities in malaysia and labuan the comprehensive range of tax benefits available in labuan ibfc makes it a very attractive jurisdiction for a variety of business and financial activities. The statutory body who is in charged with the direct tax is the malaysia inland revenue board lhdn. 2nd malaysia tax policy forum tightening malaysia s fiscal regime amidst covid 19. With indirect tax becoming many governments preferred method of revenue raising it s more critical than ever to manage compliance and cash flows.

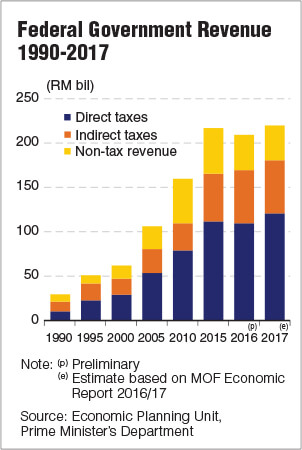

Tan eng yew deloitte malaysia indirect tax leader was invited to share on should we bring back gst to improve fiscal healthy during a forum session in the 2nd malaysia tax policy forum. The last record was set in 2014 when the direct tax collection came in at rm133 700 billion according to a. Meanwhile indirect tax is referred to as tax. Direct taxes have better allocative effects than indirect taxes as direct taxes put lesser burden over the collection of amount than indirect taxes where collection is scattered across parties and consumers preferences of goods is distorted from the price variations due to indirect taxes.

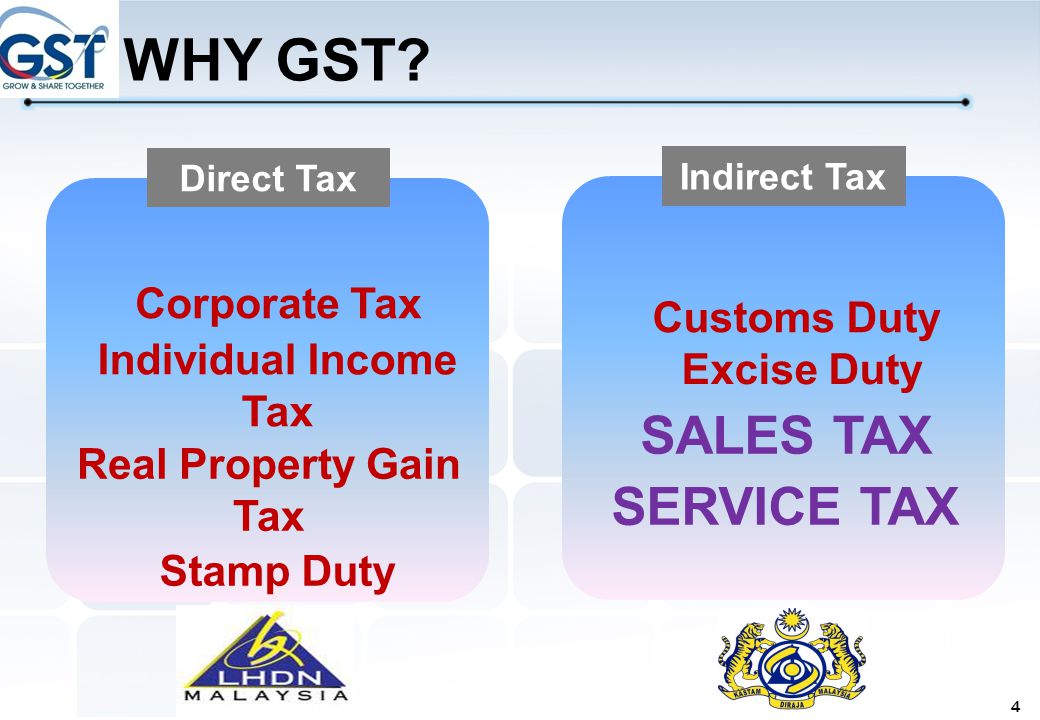

Since the repeal of the goods and services tax gst and the implementation of sales and service tax sst indirect tax risk has never been higher. The inland revenue board of malaysia achieved a new record in direct tax collection last year with rm137 035 billion collected which is 11 13 or rm13 723 billion more than the rm123 312 billion collected in 2017 the ministry of finance mof said today. Type of indirect tax. Assist in applying for indirect tax exemption including making presentation to customs malaysian investment development authority mida and or mof.

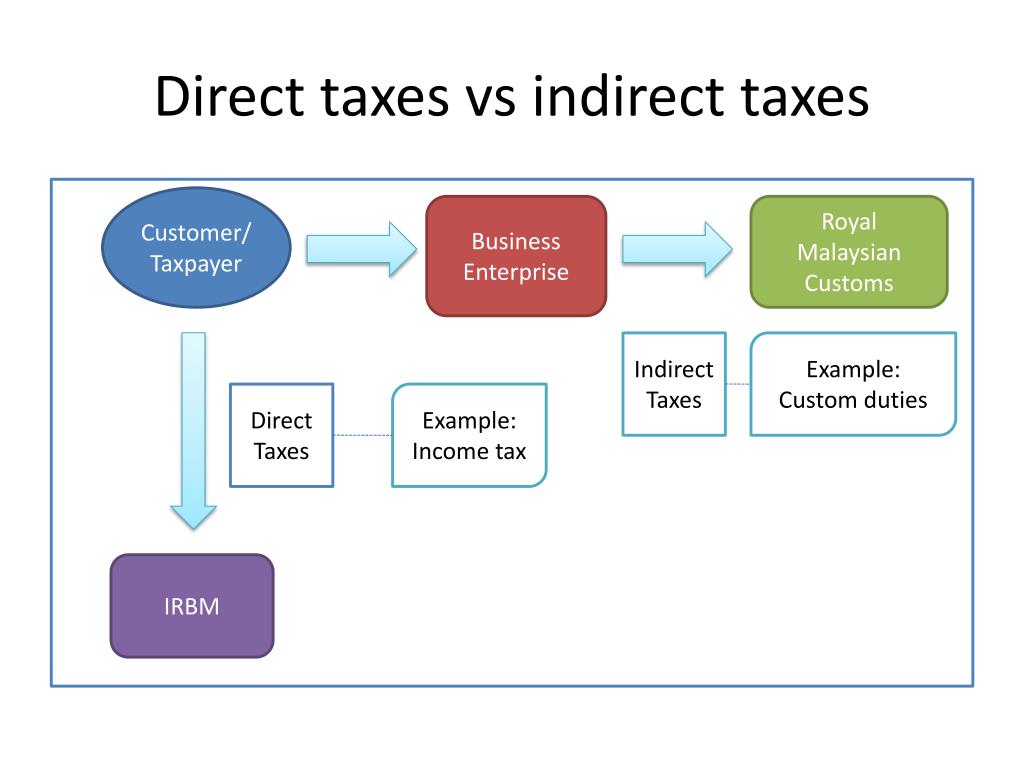

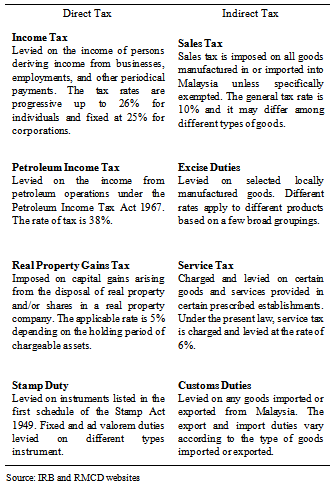

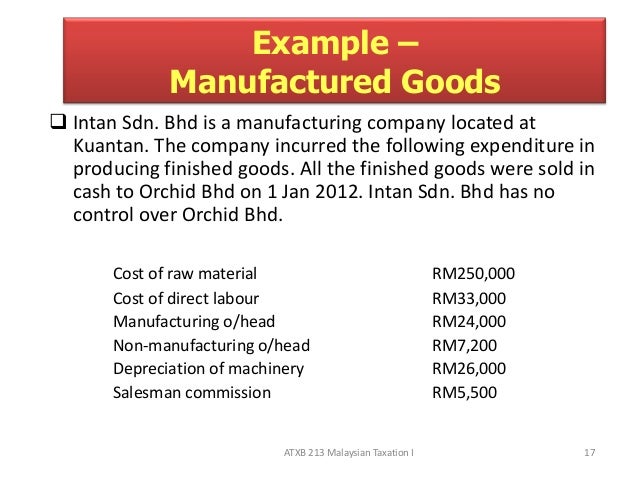

In the case of a direct tax the taxpayer is the person who bears the burden of it conversely in the case of an indirect tax the taxpayer shifts the burden on the consumer of goods and services and that is why the incidence falls on different persons come let s take a read of the article which gives you a clear understanding of the difference between a direct tax and indirect tax. Examples of direct tax are income tax and real property gains tax. A direct tax is a tax that is levied on a person or company s income and wealth. Sales tax and service tax were implemented in malaysia on 1 september 2018 replacing goods and services tax gst.

Direct taxes help in reducing inequalities and are.