Employees Provident Fund Act 1991

The provident fund act 21st november 1947 3 26 of lw9 sch.

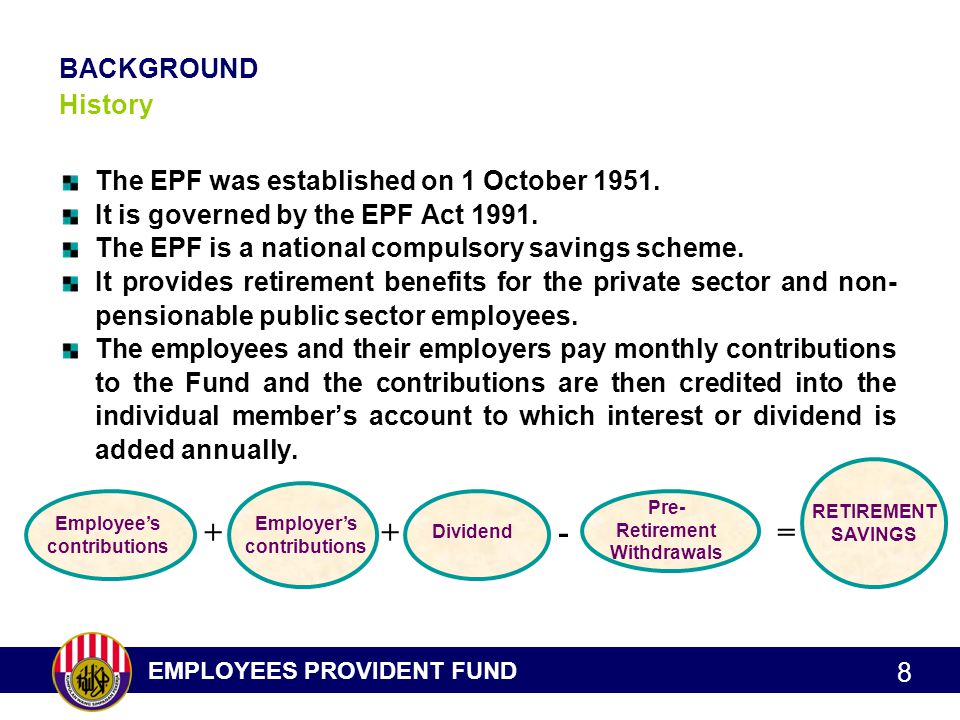

Employees provident fund act 1991. B 264 1991 be it enacted by the seri paduka baginda yang di pertuan. This act may be cited as the provident fund act. An act to provide for the institution of provident funds 2 3 pension fund and deposit linked insurance fund for employees in factories and other establishments. Provident fund act 1991 act 452 the minister makes the following order.

Epf helps you achieve a better future by safeguarding your retirement savings and delivering excellent services. Amendment of third schedule 2. Short title extent and application 4 1 this act may be called the employees provident funds and miscellaneous provisions act. Provident fund 3 cap.

Laws s of 1955 25 of 1958. 1 this order may be cited as the employees provident fund amendment of third schedule order 2004. 1 june 1991 p u. 2 this order comes into operation on 1 june 2004.

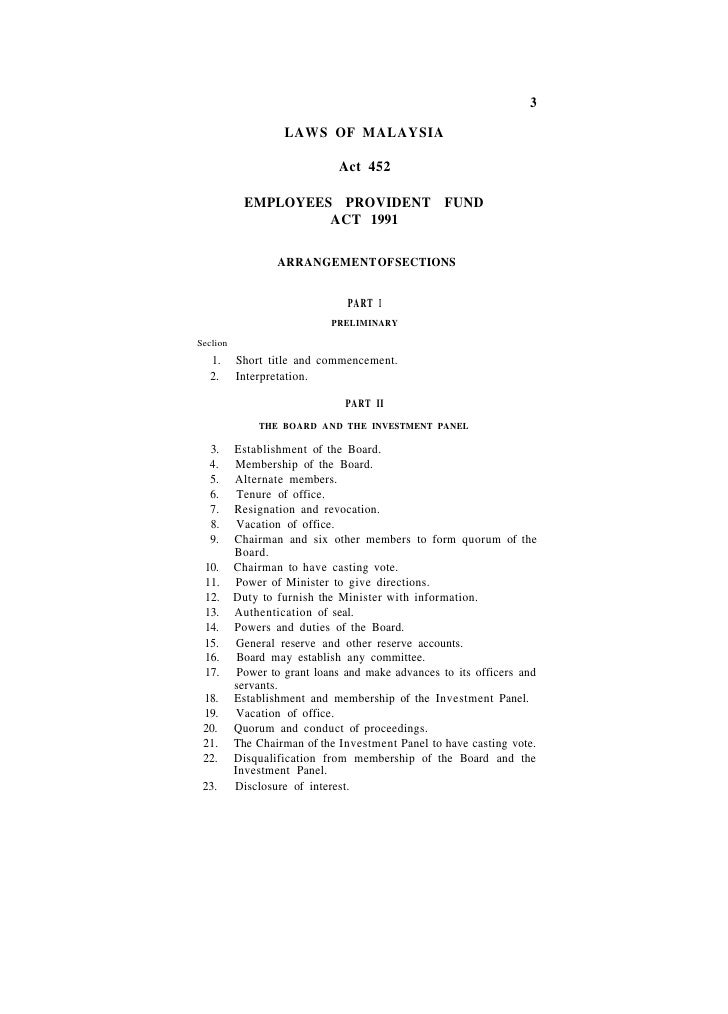

48 of 1961 49 of 1961. Acts 36 of 1976. 7 laws of malaysia act 452 employees provident fund act 1991 an act to amend and re enact the law relating to provident fund for persons employed in certain occupations and for matters incidental thereto. The employees provident fund act 1991 is amended by.

Legally the epf is only obligated to provide 2 5 dividends as per section 27 of the employees provident fund act 1991. Employees provident fund act 1991 employees provident fund 1 laws of malaysia reprint act 452 employees provident fund act 1991 incorporating all amendments up to 1 january 2006 published by the commissioner of law revision malaysia under the authority of the revision of laws act 1968 in collaboration with percetakan nasional malaysia bhd. On 18 12 2019 parliament passed a bill to amend certain provisions of the employees provident fund act 1991 epf act which will come into operation on a date to be appointed by the minister of finance by notification in the gazette. Be it enacted by parliament as follows 1.

Citation and commencement 1. The epf claims that the lowered dividend is the result of its decision to invest in low risk fixed revenue instruments which produce lower returns but maintains the principal value of its members contributions. Some of these amendments involve introduction of new provisions which are among other things meant to ensure compliance with the obligation to.