Takaful Vs Conventional Insurance

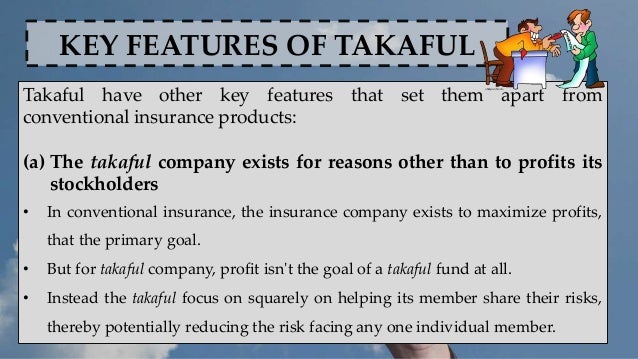

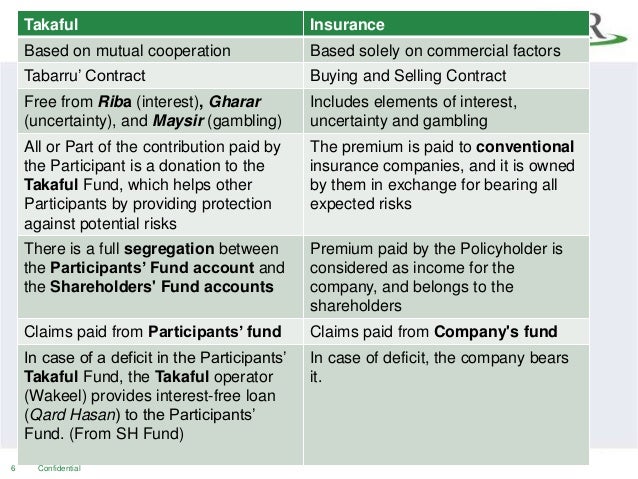

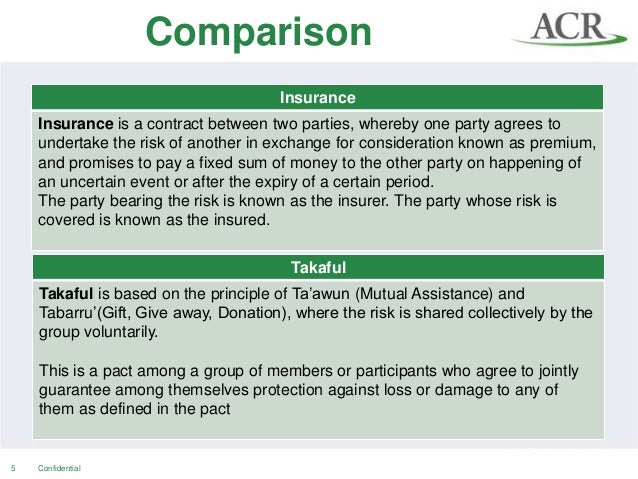

Takaful insurance is a form of co operative insurance in compliance with islamic shariah which is based on the concept of shared contributions and mutual co operation between the participants to compensate one another in case of loss.

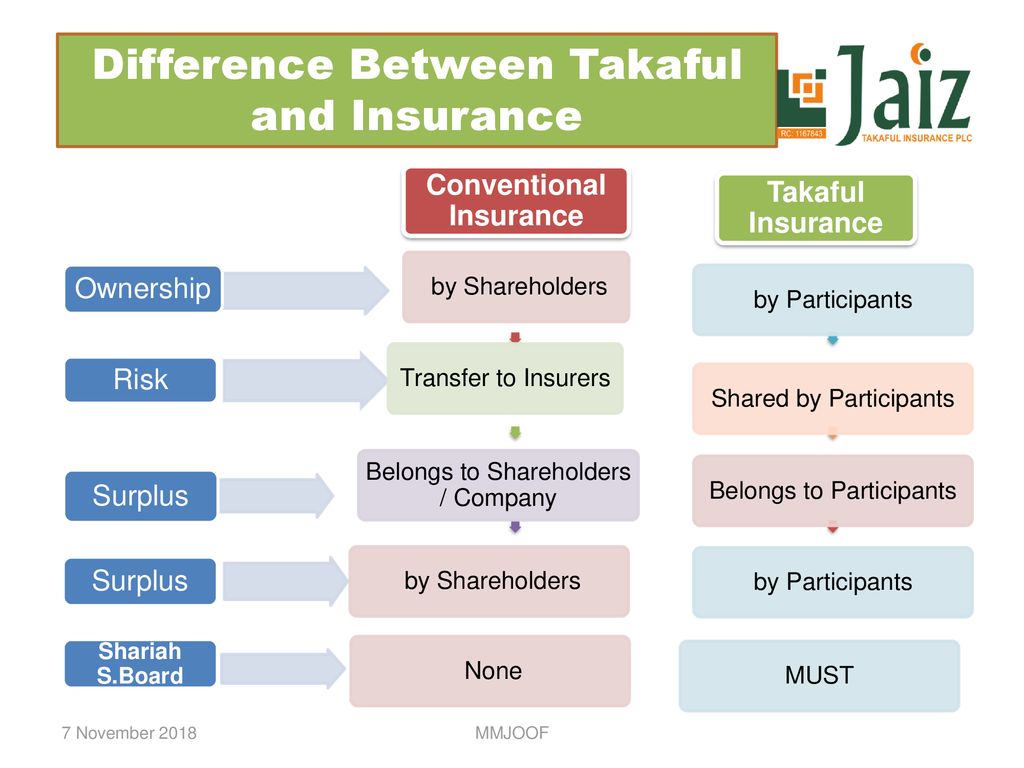

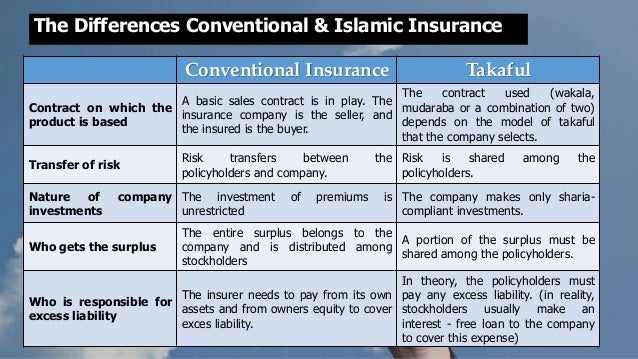

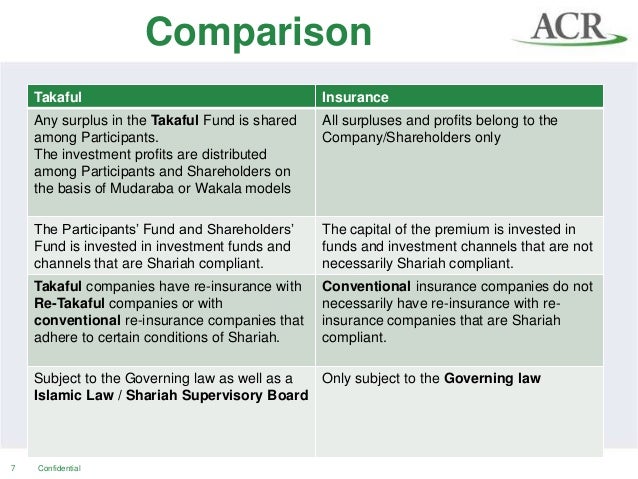

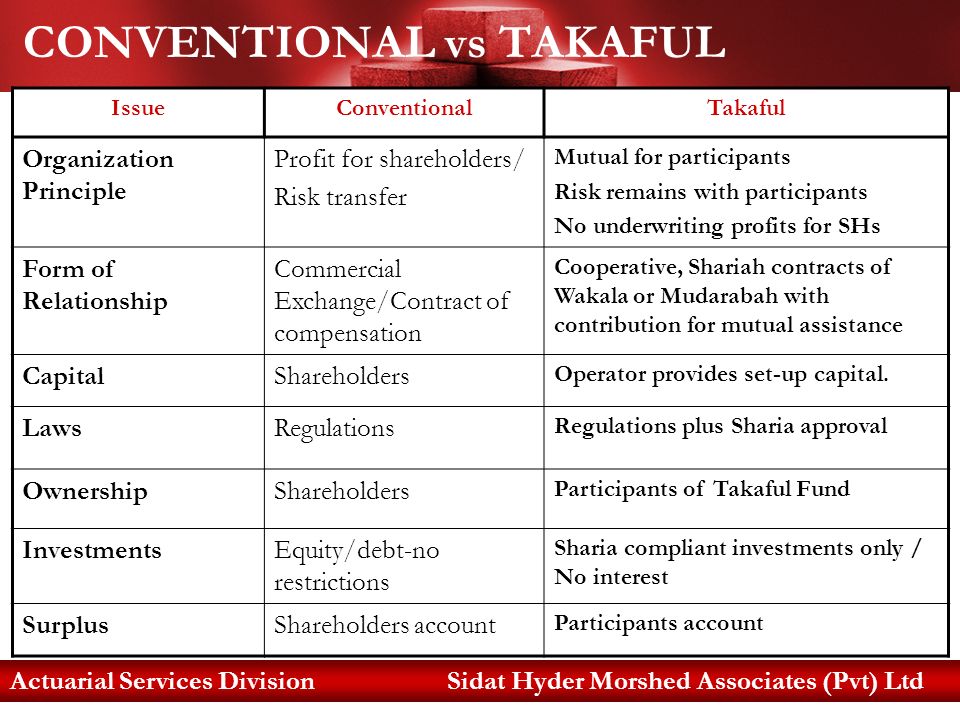

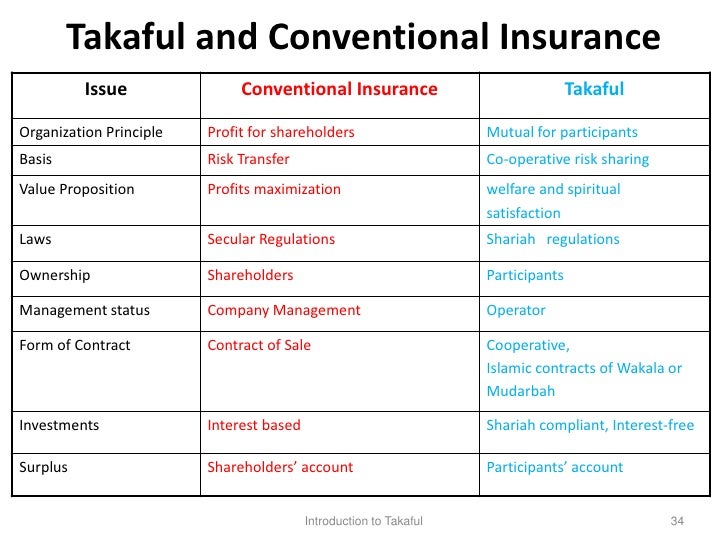

Takaful vs conventional insurance. In malaysia in comparison to many other countries takaful companies are heavily regulated through shariah requirements under the islamic financial services act 2013 separately from conventional insurers. The following table summarizes the main differences between both systems. In conventional insurance surpluses and profits belong to the shareholders of the insurance companies. Is takaful or conventional insurance cheaper.

Takaful is a relatively new insurance product that is marketed as an islamic alternative to conventional insurance and is often referred to as islamic insurance. One isn t necessarily cheaper than the other but in terms of extra risk premiums takaful insurance may be better in terms of cost. Read on to find out more so you have more insurance coverage options and to help you pick the best type of coverage for your lifestyle. Takaful pakistan limited takaful pakistan takaful karachi family takaful to spread takaful benefits beyond borders beyond time.

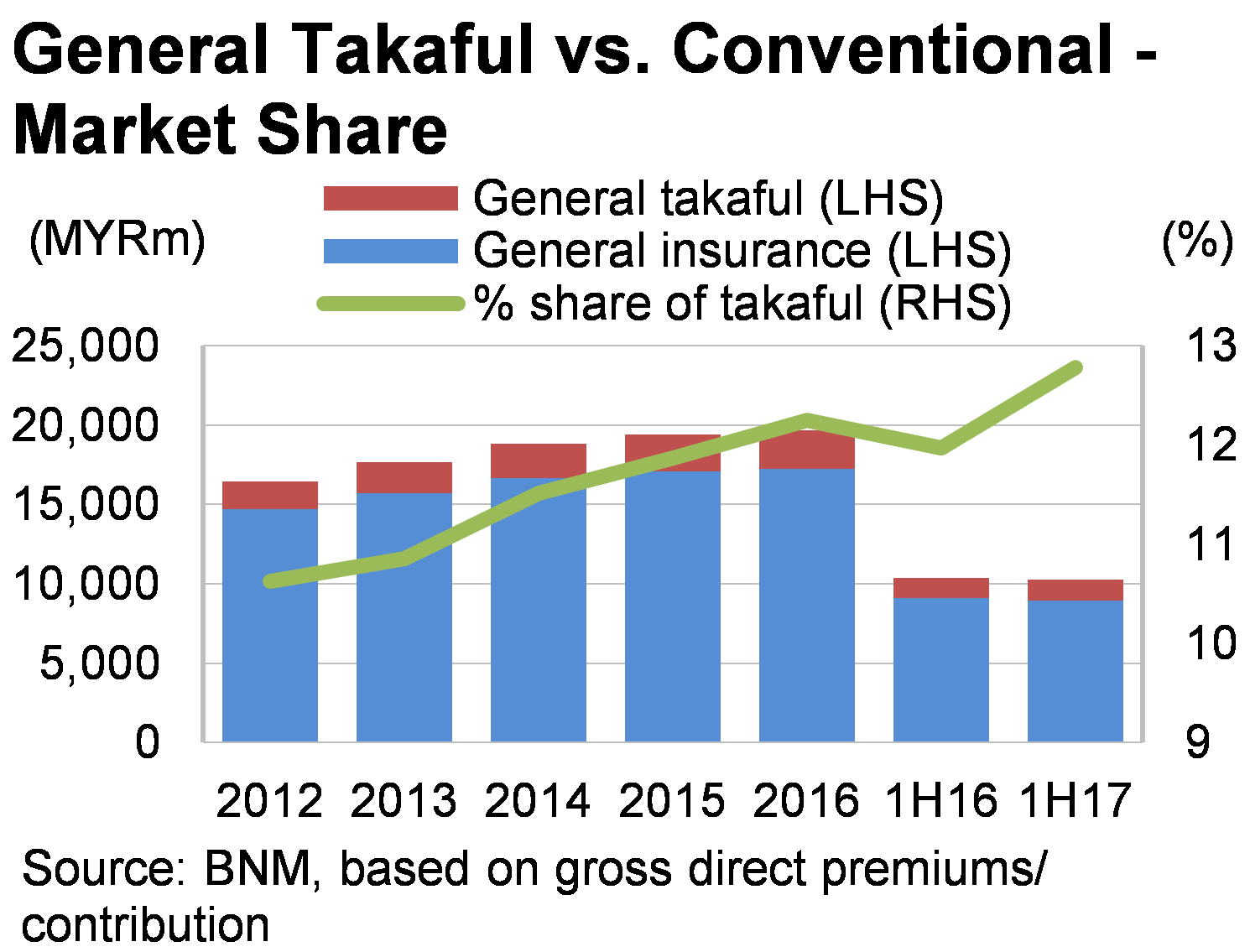

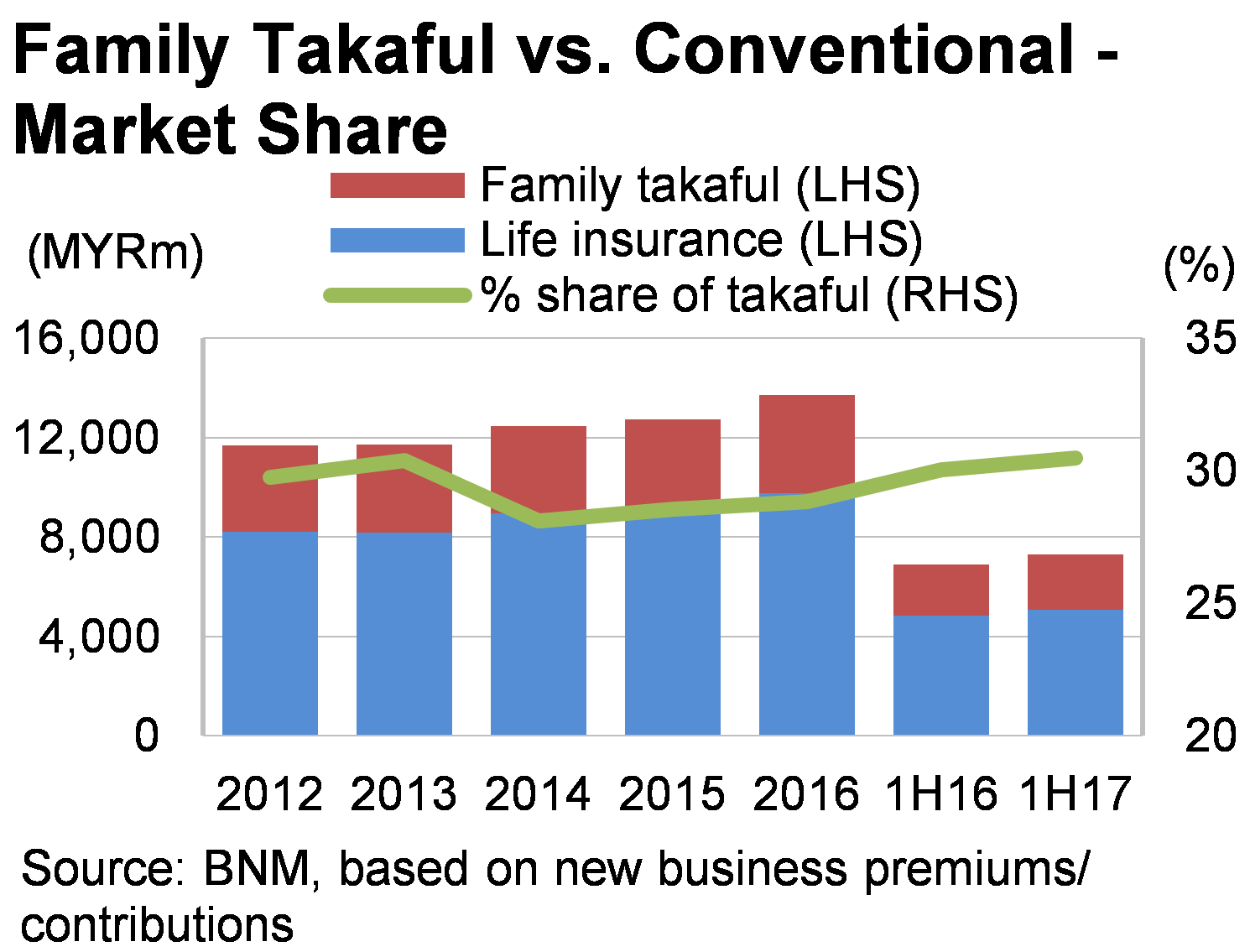

Although both conventional and takaful businesses generate profits for the shareholders in takaful business the expenses paid to the shareholders are explicitly transparent in conventional insurance they are not necessarily so. Takaful in malaysia today. This is because takaful fund rates are generally fixed and people deemed to carry extra risk aren t typically charged more unless in severe situations that would cause losses to the entire fund. In arabic takaful means solidarity and cooperation among group of people.

:max_bytes(150000):strip_icc()/PROJECT-DEVELOPER-9bddde300c994be3871dd9790d15f7bb.jpg)