Monetary Policy In Malaysia

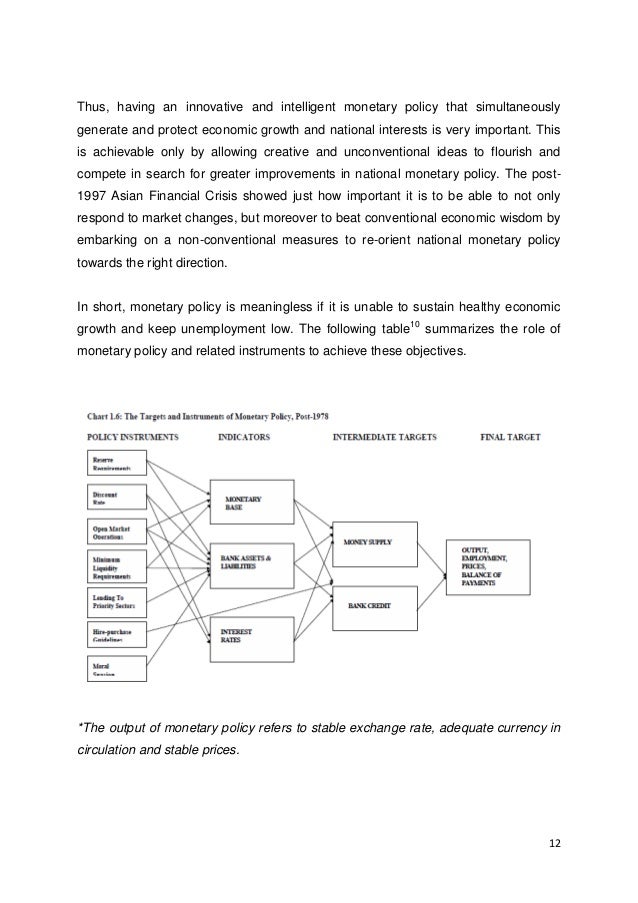

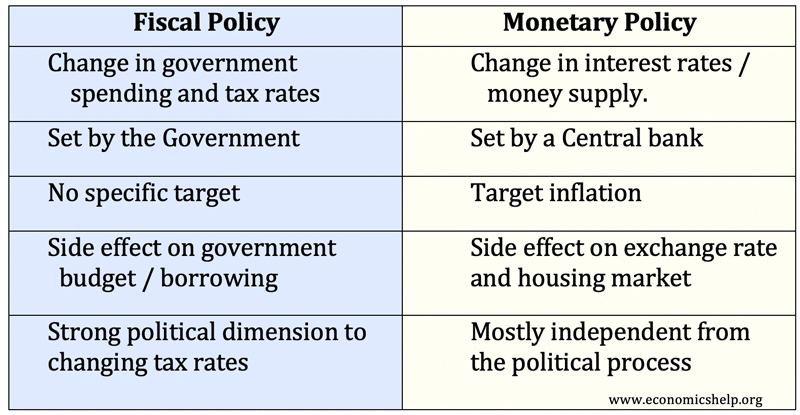

Maintain tight monetary policy.

Monetary policy in malaysia. Meanwhile on the monetary stance bank negara malaysia reduced the overnight policy rate by 25 basis points to 2 50 per cent early this month the second cut this year to support projected improvement in economic growth amid price stability. Monetary policy statement ref no. Malaysia s central bank will decide monetary policy just a few days prior to the government unveiling the budget for 2021. At its 10 september meeting the monetary policy committee of bank negara malaysia bnm decided to maintain the overnight policy rate at its all time low of 1 75 amid divided market analysts expectations.

Whereby our money is downgraded to the peak level enforcing the government to increase the loan interest rate and effect the economic wholly regardless of discrimination in any race in as what the economic policy was. The second wave of the pandemic strengthens the case for more policy support but elevated political uncertainty casts a dark overshadow. At its 2 3 march meeting the monetary policy committee of bank negara malaysia bnm voted to lower the overnight policy rate opr by 25 basis points to 2 50 while the ceiling and floor of the opr corridor were reduced to 2 75 and 2 25 respectively. The possibility could not be discounted as the country s economic outlook is.

Monetary policy in 2016 is focused on ensuring steady expansionof the domestic economy. The move had been expected by market analysts. As reported by joseph chin 2016 in the star online on 13 th july 2016 bank negara malaysia bnm has unexpectedly reduced the overnight policy rate opr by 25 basis points to 3 at its monetary policy committee mpc meeting citing rising risks from britain s exit from the european union. In the first 6 months of 2016 the malaysian economy grew 4 1 with inflation averaging at 2 7.

The last time when monetary policy happens to change was during the malaysia s inflation period during 1998. This move could see banks lowering their lending rates and making it cheaper and companies to take loans. Kuala lumpur march 16 the government may introduce additional monetary policy and fiscal stimulus soon to cushion the economy from any downside risks associated with the covid 19 outbreak according to analysts. In the efforts to ensure sufficient liquidity in the domestic financial system and to support the orderly functioning of the domestic financial markets the srr was reduced from 4 00 to 3 50 effective on 1.

The bank s decision to pause its easing cycle was driven by signs of recovery and its assessment that the recent cuts in combination with previous fiscal stimulus were. The decision came amid growing risks to the outlook from the coronavirus. Despite a slowdown in growth it is essential to maintain a tight monetary policy to contain inflationary pressures arising from the depreciation of ringgit.