Risk Free Rate Malaysia

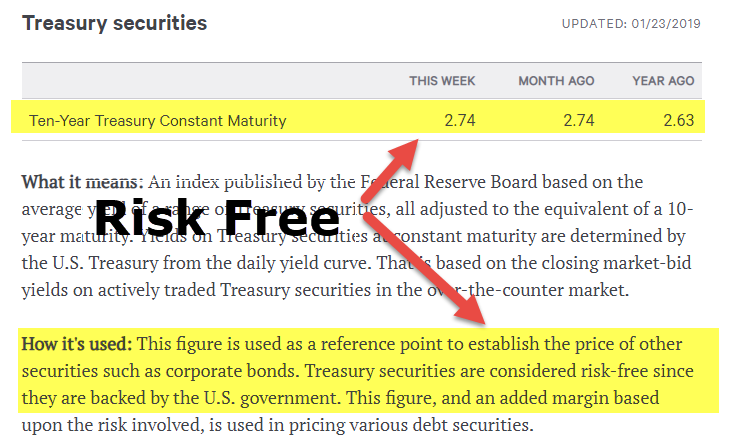

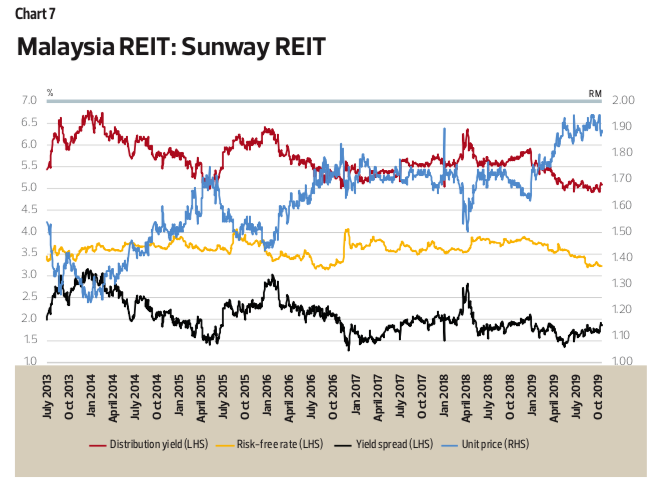

As a proxy of the risk free rate we used 3 87 the yield of 20 year malaysian government securities as extracted from the bank negara malaysia website.

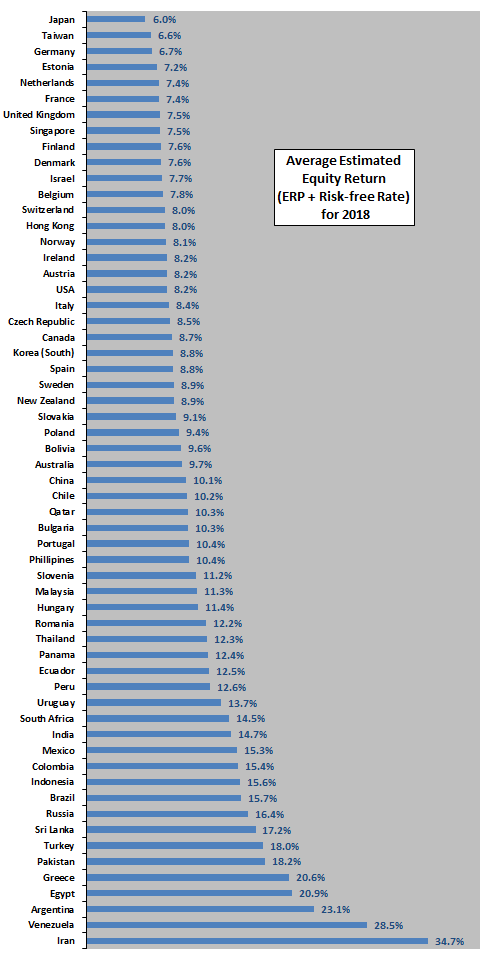

Risk free rate malaysia. Expected market return of 10 61 was extracted from bloomberg. Malaysia 10y bond yield was 2 63 percent on friday october 30 according to over the counter interbank yield quotes for this government bond maturity. The malaysia credit rating is a according to standard poor s agency. The 20 year tenure is in line with the concession period as per the o m agreement.

Daily 3 and 6 month noon forward swap rates of ringgit. Bpam now stands as the premier source of market neutral evaluated prices and data on myr bonds. Kuala lumpur usd myr reference rate. A reference rate that is computed based on weighted average volume of the interbank usd myr fx spot rate transacted by the domestic financial institutions and published daily at 3 30 p m.

Magy10yr is used as risk free rate market return is the capital weighted average of the internal rate of return for all major index numbers. Indicative prices coupon rates yield and remaining maturities of securities issued by the malaysian government. Provides comprehensive malaysia s bonds market information and analysis yield curve for malaysian goverment bond malaysian government securities mgs islamic bond cagamas khazanah bond and corporate bond. Access to personalized wacc calculation.

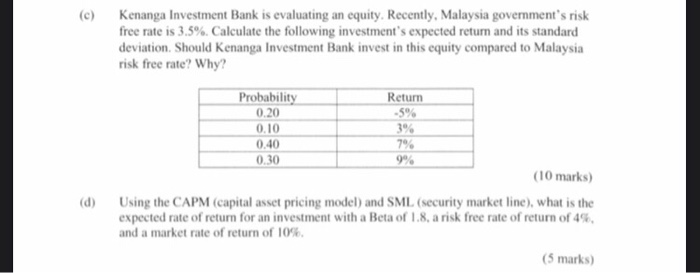

The risk free rate and market return fluctuate daily. The malaysia 10y government bond has a 2 633 yield. In the wacc for is based on your company s specific characteristics it can vary from to. In the case of malaysia the malaysia govt bonds 10 year yield bloomberg ticker.

Download a detailed report justifying our analysis. For example if the current market value is mv 0 100 and dividend forecasts are d 1 4 d 2 4 d 3 4 then a growth rate of 0 results in an implied cost of capital of 4 if the growth rate assumption is 5 the implied cost of capital is 8 6. Obtain sources justifying the wacc calculation. Naively applied it can have a huge impact on implied cost of capital estimates.

Central bank rate is 1 75 last modification in july 2020. In order to read this document you will need adobe acrobat reader which is downloadable for free from the adobe web site. Current 5 years credit default swap quotation is 57 19 and implied probability of default is 0 95.